Table of Contents

GST Math

- September 20 Goods and Services Tax(GST) Council meeting

- Rate reductions aimed at boostingdemand during the festive season.

- Finance Mnistry: wants to estimate therevenue it would lose

- Fitment panel: comprises central andstate officials

- Fitment panel that examines ratechanges is expected to meet shortly

- Among big-ticket consumer items,automobiles, tyres, cement, air conditioners and large LCD televisions are currently in the 28% bracket.

- RBI rate cut: 35 Bps

- Some say now Govt should take a call

Link Loans to Benchmarks

- Reserve Bank of India (RBI) has made itmandatory for banks to link loans to external interest rate benchmarks.

- Aim: to make transmission of monetarypolicy more effective.

- The RBI also suggested a series of ratesthat lenders can choose from as the peg.

- The RBI has already cut the policy rateby 110 basis points this year

- Banking conference last month, Dassaid: the transmission of policy rates at just 29 basis points (bps) this year, compared with a combined repo rate cut of 75 bps (excluding the 35bps cut in August), did not meet RBI’s expectations.

India-US Deal

- 10 Boeing P8I maritime patrolaircraft

- $3.1-billion deal to acquire maritimeaircraft for the Navy.

- Surveillance capabilities in the IndianOcean Region.

- Mandatory clause for at least 30%offsets to domestic companies.

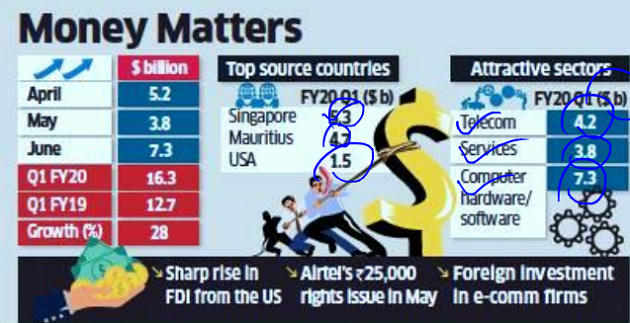

FDI Inflows

- Foreign direct investment (FDI) equity inflows rose 28%in the first quarter of 2019-20.

- $16.3 billion from $12.7 billion in the year-ago period

- Financial

- Banking

- Insurance

- Non-financial/business

- Outsourcing

- Research and development

- Courier

- Technology testing & analysis

- India-bound FDI had dipped 1% to$44.4 billion in 2018-19 from $44.8 billion in the previous fiscal.

- This was the first decline in six years.

- While Mauritius does not provide anytax incentives anymore, a lot of investors use Singapore as their regional headquarters

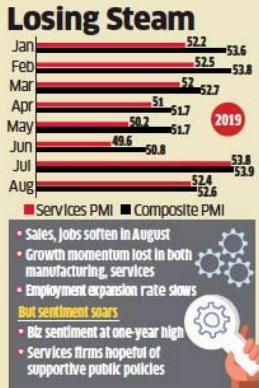

Services PMI Dips

- The IHS Markit India ServicesPurchasing Managers’ Index (PMI)

- India’s services sector activitysoftened in August as job creation and output expansion moderated.

- Services PMI: declined to 52.4 inAugust, in July it was 53.8.

- Manufacturing PMI: slipping to a 15-month low in August.

- The IHS Markit India Composite PMIOutput Index that maps both the manufacturing and services industries fell to 52.6 in August from 53.9 in July.

- Govt measures: opening up foreigndirect investment in contract manufacturing, easing norms for overseas investors in single brand retail and coal mining, rolling back enhanced surcharge on foreign portfolio investors.

Infra Players

- Finance minister Nirmala Sitharaman metrepresentatives from the infrastructure industry.

- Aim: to understand issues faced by them

- Concerns: pace of execution of projects,lack of investor frinedliness, financing and land issues

- This was part of series of sectoralmeetings being held by Sitharaman

Download Free PDF

WhatsApp

WhatsApp