Table of Contents

DEBT IN DEVELOPED ECONOMIES?

- If the economy grows faster then the debt will also increase.

- It is but natural for most of the developed economies.

- USA & Japan has a debt problem, too.

- Its debt to GDP ratio is 106% & 250% respectively.

- These are large numbers. But they are fairly accurate and well-known.

- Hence the investors invest accordingly looking at the Debt & GDP figure.

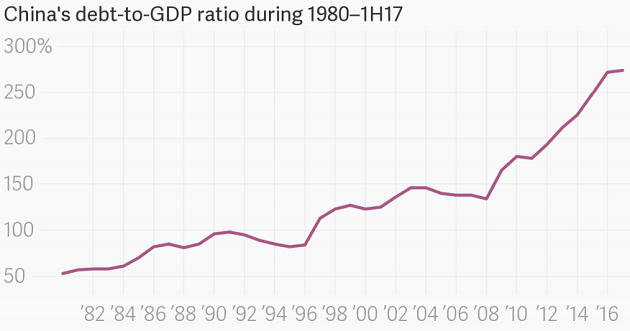

- That isn’t the case with China’s debt. Officially, it is a small number: 47.60%.

- Unofficially, it’s hard to figure it out.

- Reason: the government is both the lender and the borrower.

- One branch of the government lends money to another branch of government.

FOR EXAMPLE

- Government-owned banks, for instance, lend money to State Owned Enterprises and Town Village Enterprises.

- In India for example, SBI is lending huge amount to BHEL, SAIL in huge amount without much security.

WHAT THIS MEANS?

- It means the money borrowed by State Owned Enterprises from the Government-owned banks doesn’t show in the official figure of Public Debt of China.

- That’s why the official figure of China’s debt to GDP shows below 50%.

- And the unofficial figure is estimated at around 300%.

UNOFFICIAL ESTIMATES

- The Institute of International Finance, Inc. (IIF) is a global association of financial institutions.

- Created by 38 banks of leading industrialized countries in 1983 in response to the international debt crisis of the early 1980s.

SO WHAT IS THE PROBLEM?

- It creates bubble in the economy & the potential of a systemic collapse.

- Like the Greek crisis.

- In Greece, government-controlled, banks and pension funds & the creditors were government-owned enterprises.

- The situation could be more severe in China.

- The government simultaneously owns banks, pension funds, and common corporations.

- Banks also lend funds to land developers.

- They are behind the country’s “investment” bubble, one of the engines of the Chinese economy.

- But there’s one big difference:

- China is huge compared to Greece.

- So if there’s a financial crisis in China, the impact on the global economy will be huge, too.

Latest Burning Issues | Free PDF

WhatsApp

WhatsApp