Table of Contents

- Contents

- Introduction

- Tax Proposals

- Urban Landscape

- Transport Infrastructure

- Industries

- Financial Sector

- Water & Sanitation

- Universal Health Coverage

- Education

- Skills, Employment & HRD

- Agriculture

- Environment & Forest

- Gender Budgeting & Elderly

- Northeast Development

Introduction

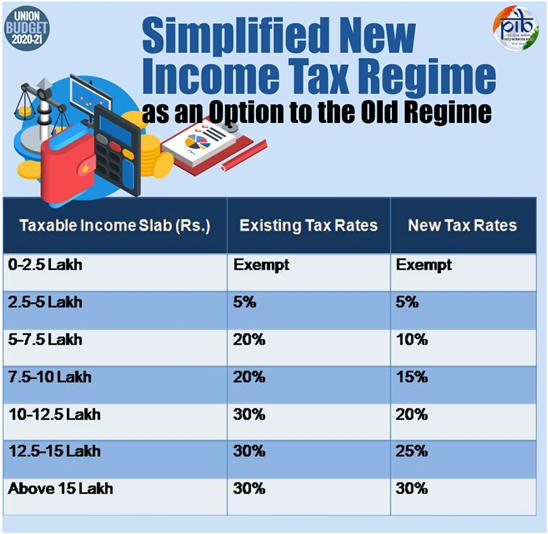

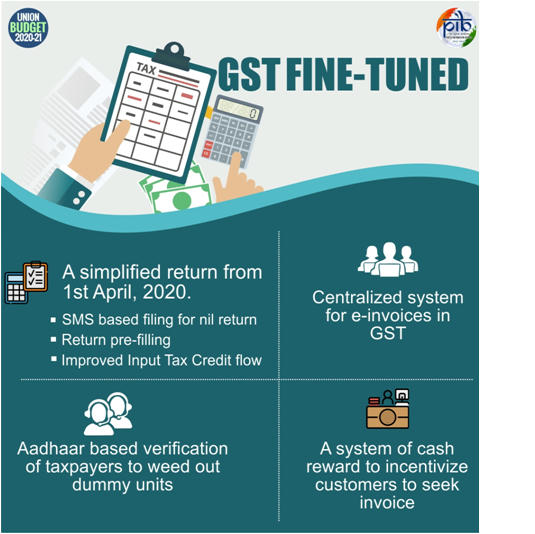

Tax Proposals

Others | Direct Tax

- Dividend Distribution Tax (DDT) removedmaking India a more attractive investment destination

- Start-ups with turnover up to Rs. 100 crore to enjoy 100% deduction for 3 consecutive assessment years out of 10 years.

- Tax payment on ESOPs deferred

- Cooperative societies exempted from Alternate Minimum Tax (AMT) just like Companies are exempted from the Minimum Alternate Tax (MAT).

- Tax concession for foreign investments:

- 100% tax exemption to the interest, dividend and capital gains income on investment made in infrastructure and priority sectors before 31stMarch, 2024 with a minimum lock-in period of 3 years by the Sovereign Wealth Fund of foreign governments.

Others | Indirect Tax

- Excise duty proposed to be raised on Cigarettes and other tobacco products, no change made in the duty rates of bidis.

- Customs Act being amended to enable proper checks of imports under FTAs.

- Anti-dumping duty on PTA abolished to benefit the textile sector.

- Provisions for checking dumping of goods and imports of subsidized goods being strengthened.

- Q #1

- Vivad Se Vishwas’ scheme is aimed at reducing litigations in:

- direct taxes

- indirect taxes

- Both 1 & 2

- Neither 1 nor 2

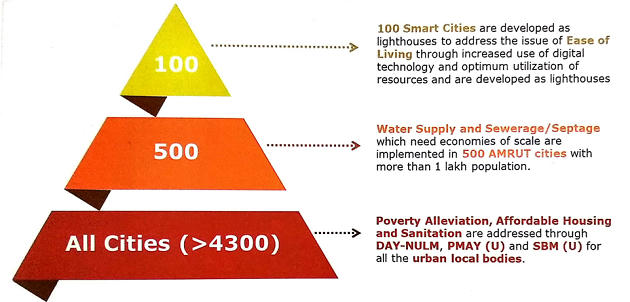

3. Urban Landscape

- Story in numbers

- Urban Population

- Currently – 34%

- By 2030 – 40%

- By 2050 – 50%

- Urban share of GDP

- 2009-10 – 62-63%

- 2030 – 75%

Urbanization Strategy of India

- Overall Investment in Urban Rejuvenation

Progress | SBM

- B/w 2014 & 2020

- 10 Cr toilets in rural areas

- 65 L household toilets + 6 L public toilets in urban areas

- 60% municipal wards practice source segregation (from 41%)

- All cities of 35 States/UTs => ODF

- 699 districts, 2.5 L GPs and 6 L villages => ODF

AMRUT

- Focuses on ensuring:

- water supply, sewerage and septage management

- storm water drainage

- urban transport

- availability of green and open spaces

- reform management and support

- capacity building

Progress |AMRUT

Key figures:

- More than 5000 projects under construction/completion

- 64% urban households have tap water supply

- On track to achieve 62% sewerage coverage by 2020

Key reforms:

- Online Building Permission System in more than 1500 ULBs

- Replacement of streetlights with LED lights (74 Lakh)

- Credit Rating (36 cities have A and higher rating)

- Municipal Bonds worth Rs. 3300 Cr issued

- Ahmedabad, Amravati, Bhopal, Hyderabad, Pune, Surat & Vizag

- Jal Shakti Abhiyan – Urban (July 2019) – for water conservation

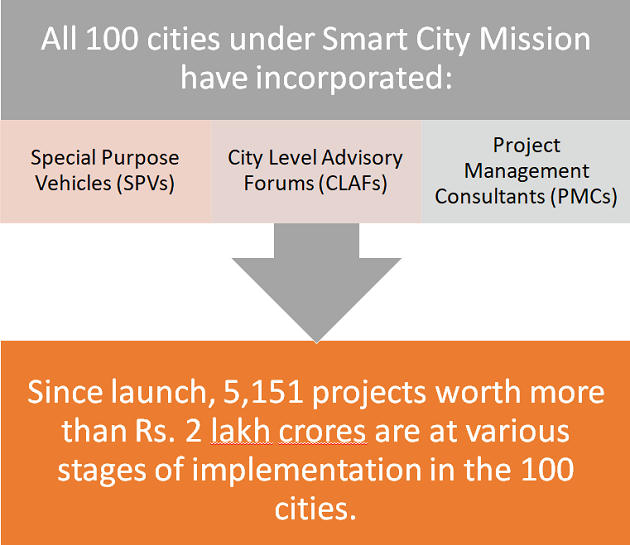

Progress | SCM

Progress | SCM

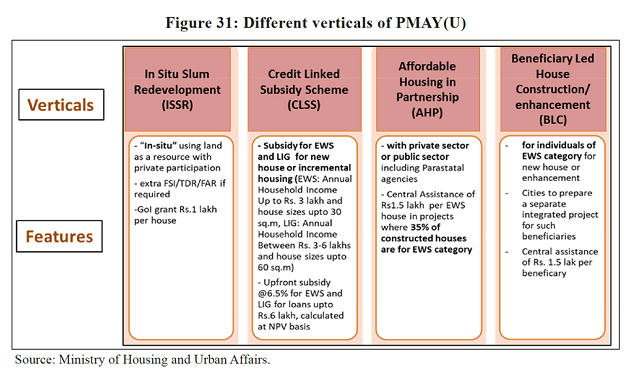

PMAY (U)

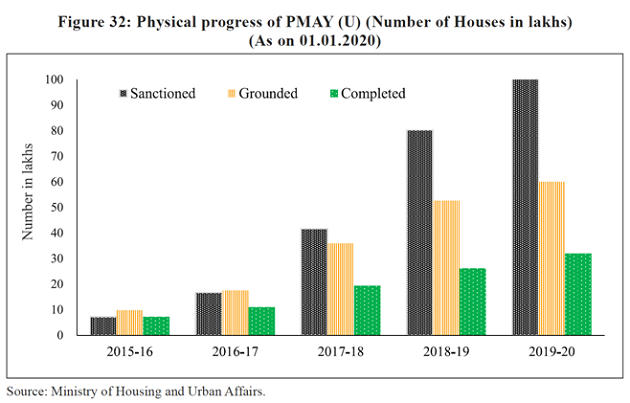

Progress | PMAY (U)

- It is rapidly moving towards achieving the vision for providing a pucca house to every household by 2022.

- Out of 1.03 crore houses approved, 60 lakhs have been grounded for construction, of which 32 lakh houses have been completed and delivered.

Progress | EODB

- Budget announcements

- National Infrastructure Pipeline

- 103 lakh crore worth projects; launched on 31st December 2019 for the period 2020-2025.

- More than 6500 projects across sectors, to be classified as per their size and stage of development.

- 16% has been earmarked for urban rejuvenation

- 1-year internships to fresh engineers in all ULBs in order to enhance the skill of the youth

4. Transport Infra

Context

- To achieve the GDP of $5 trillion by 2024-25, India needs to spend about $1.4 trillion (` 100 lakh crore) over these years on infrastructure

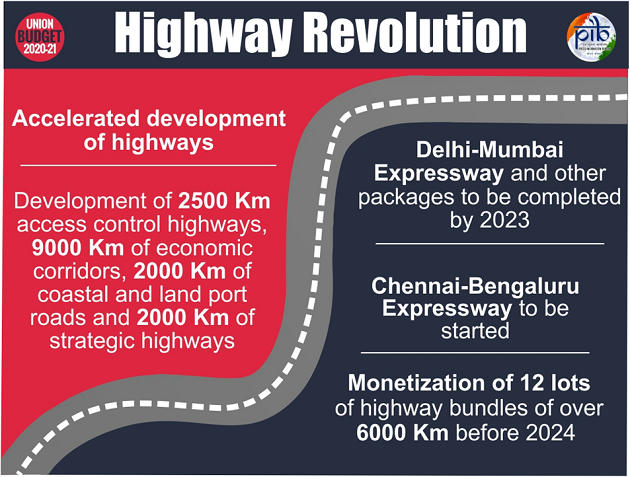

Roads

- Road transport is the dominant mode of transportation in terms of its contribution to Gross Value Added (GVA) and traffic share.

- As per Govt. report, in 2011-12, road transport is estimated to handle 69% and 90% of the countrywide freight and passenger traffic

- As on Mar 2018, India had a road network of about 59.64 lakh km. The total length of NHs was 1.32 lakh km as on Mar 2019.

- The pace at which roads have been constructed has grown from 17 kms per day in 2015-16 to 29.7 kms per day in 2018-19.

- However, the pace seems to have moderated to 12 kms per day in 2019-20.

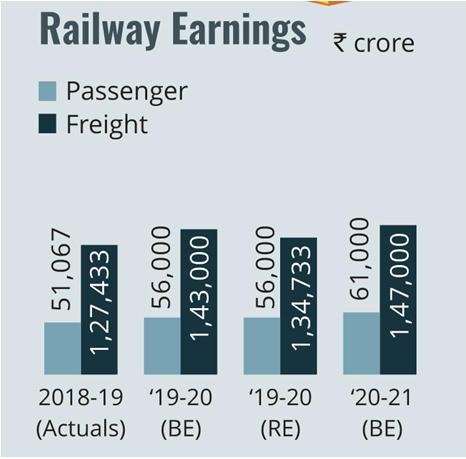

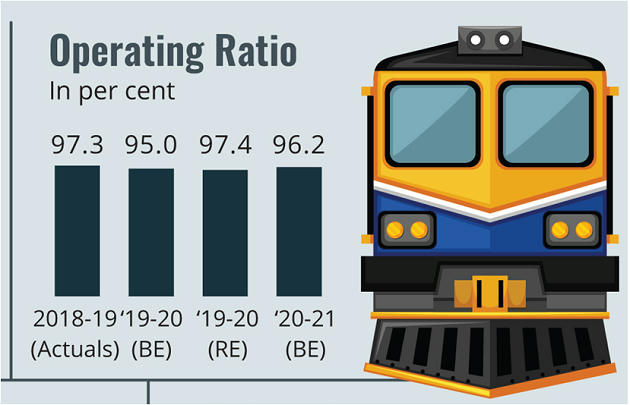

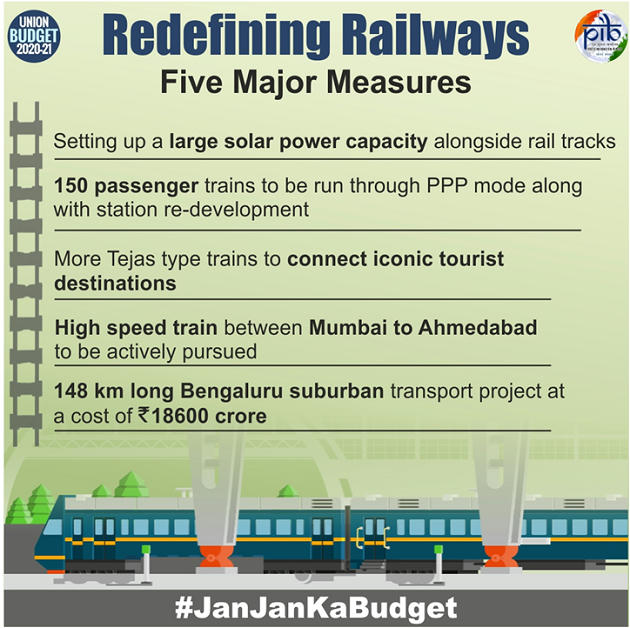

Railways

- Indian Railways (IR) with over 68,000 route kms is the third largest network in the world under single management.

- During 2018-19, it carried 120 crore tonnes of freight and 840 crore passengers making it the world’s largest passenger carrier and 4th largest freight carrier.

Critical Challenges in Railways Modernization

- Fundamentals of how PPPs would be encouraged

- R&D for indigenous manufacturing of Rolling Stock

Aviation

- India is the 3rd largest domestic market for civil aviation in the world.

- India has 136 commercially-managed airports by AAI and 6 under PPP for Operation, Maintenance and Development of airports.

- A total of 43 airports have been operationalized under UDAN

- To ease the strain, 100 more airports are to be made operational by FY 2023-24

- To bring in efficiency and resources, 6 airports (Ahmedabad, Guwahati, Jaipur, Lucknow, Mangalore, and Thiruvananthapuram) have been taken up for development under PPP mode

Focus areas in Aviation

- Increasing capacity and service levels in top 30 airports via PPP

- Increasing no. of airports to about 100 and ensuring that all tier II and tier III cities have their own airports

- Attracting PPPs in lower tier cities is difficult because of viability – may need VGF / subsidies to make workable

- AAI is fallback option but concerns about AAI managing many loss-making airports is there

Shipping

- Around 95% of India’s trade by volume and 68% in terms of value is transported by sea.

- Despite one of the largest merchant shipping fleet (> 1400) among developing countries, India’s share in total world dead weight tonnage (DWT) is only 0.9% as on January 1, 2019 according to Institute of Shipping Economics and Logistics.

Issues highlighted by Professor G Raghuram

- Sagarmala is not proceeding at the pace envisaged – a part of the problem is environment but there is also a problem of need

- Capacity additions may not be needed unless for captive purposes

- There could possibly be a situation of excess capacity in container domain

- Could also be the case for coal – as power sector moves towards renewables

- Some earlier PPPs not able to perform well due to restrictive concession agreements

- Need restructuring of regulatory regime

- Connectivity issues on land side, esp. rail, should improve with DFCs and formation of Indian Port Rail Corp. Ltd. (formed in 2015)

Air & Rail for Farm

- Krishi Udaanto be launched by the Ministry of Civil Aviation:

- Both international and national routes to be covered.

- North-East and tribal districts to realize Improved value of agri-products

- Kisan Railto be setup by Indian Railways through PPP:

- To build a seamless national cold supply chain for perishables (milk, meat, fish, etc.

- Express and Freight trains to have refrigerated coaches.

Money?…….National Infrastructure Pipeline

- Launched on 31 Dec 2019, would commence in phases from 2020-21 to 2024-25

- 103 lakh crore worth projects

- Energy = 24%

- Urban = 16%

- Roads = 19% | Railways = 13% | Airports = 1.3% | Ports = 1%

- More than 6500 projects across sectors, to be classified as per their size and stage of development.

- Central Govt. (39%) and State Govt. (39%) will have equal share in funding followed by Private Sector (22%).

- It is expected that private sector share may increase to 30% by 2025.

- Q #2

- Vivad Se Vishwas’ scheme is aimed at reducing litigations in:

- direct taxes

- indirect taxes

- Both 1 & 2

- Neither 1 nor 2

5. Industries

Industry, Commerce & Investment

- Investment Clearance Cellproposed to be set up:

- To provide “end to end” facilitation and support

- To work through a portal

- National Technical Textiles Missionto be set up:

- With four-year implementation period from 2020-21 to 2023-24.

- At an estimated outlay of Rs 1480 crore.

- To position India as a global leader in Technical Textiles.

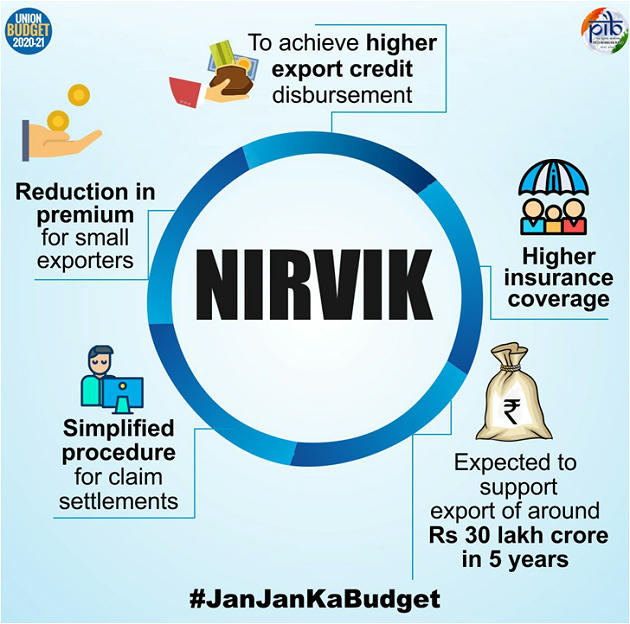

- New scheme NIRVIKto achieve higher export credit disbursement

Industry, Commerce & Investment

- Turnover of Government e-Marketplace (GeM) proposed to be taken to Rs 3 lakh crore.

- Scheme for Revision of duties and taxes on exported products to be launched.

- Exporters to be digitally refunded duties and taxes levied at the Central, State and local levels, which are otherwise not exempted or refunded.

- All Ministries to issue quality standard orders as per PM’s vision of “Zero Defect-Zero Effect” manufacturing.

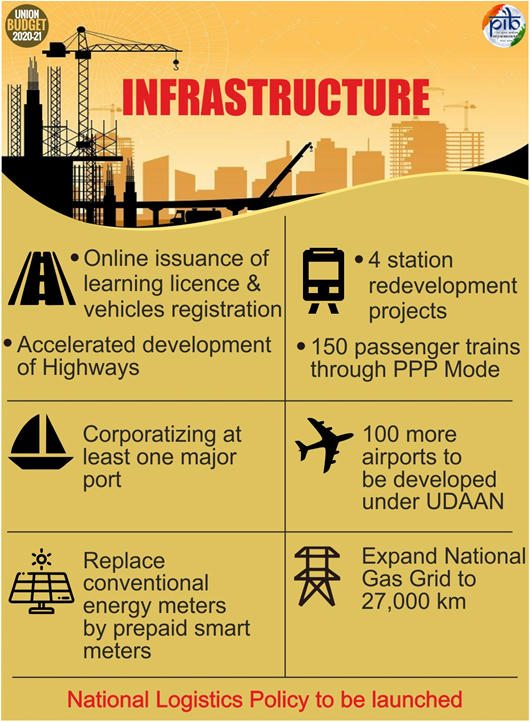

Infrastructure

- 100 lakh crore to be invested on infrastructure over the next 5 years

- National Logistics Policy to be released soon:

- To clarify roles of the Union Government, State Governments and key regulators.

- A single window e-logistics market to be created

- Focus to be on generation of employment, skills and making MSMEs competitive.

- National Skill Development Agency to give special thrust to infrastructure-focused skill development opportunities.

- Project preparation facility for infrastructure projects proposed.

- To actively involve young engineers, management graduates and economists from Universities.

- infrastructure agencies to involve youth-power in start-ups.

Infrastructure | Connectivity

- To take advantage of new technologies:

- Policy to enable private sector to build Data Centre parks throughout the country to be brought out soon

- Fibre to the Home (FTTH) connections through Bharatnet to link 100,000 GPs this year

- 6000 crore proposed for Bharatnet programme in 2020-21

Startups

- A digital platform to be promoted to facilitate seamless application and capture of IPRs.

- Knowledge Translation Clusters to be set up across different technology sectors including new and emerging areas.

- Mapping of India’s genetic landscape- Two new national level Science Schemes to be initiated to create a comprehensive database.

- Early life funding proposed, including a seed fund to support ideation and development of early stage Start-ups.

Financial Sector

- Q #3

- Vivad Se Vishwas’ scheme is aimed at reducing litigations in:

- direct taxes

- indirect taxes

- Both 1 & 2

- Neither 1 nor 2

7. Water & Sanitation

Protocols

- ODF protocol – independent third party certifies a city as ODF on satisfying certain requirements. To prevent it from slippage, the certification has to be renewed every 6 months.

- ODF+ protocol – to track maintenance of acceptable levels of cleanliness in community/public toilets so that they are functional and actually used by citizens. 739 cities are ODF+.

- ODF++ protocol – to track what was happening to faecal sludge being discharged from the toilets => for complete sewage and faecal sludge management. 292 cities are ODF++.

- SBM Water+ focuses on ensuring that no untreated wastewater is discharged into the open environment.

8. Universal Health Coverage

- Q #4

- Vivad Se Vishwas’ scheme is aimed at reducing litigations in:

- direct taxes

- indirect taxes

- Both 1 & 2

- Neither 1 nor 2

9. Education

10. Skills, Employment & HRD

- Q #5

- Vivad Se Vishwas’ scheme is aimed at reducing litigations in:

- direct taxes

- indirect taxes

- Both 1 & 2

- Neither 1 nor 2

11. Agriculture

12. Environment & Forest

Q #6

- Vivad Se Vishwas’ scheme is aimed at reducing litigations in:

- direct taxes

- indirect taxes

- Both 1 & 2

- Neither 1 nor 2

13. Gender Budgeting & Elderly

14. NE Development

- Q #7

- Vivad Se Vishwas’ scheme is aimed at reducing litigations in:

- direct taxes

- indirect taxes

- Both 1 & 2

- Neither 1 nor 2

Download Free PDF – Yojana Magazine

WhatsApp

WhatsApp