Table of Contents

Essential Commodities Act

- Finance minister Nirmala Sitharaman rolled out sweeping reforms for the farm sector.

- The Essential Commodities Act will be amended to deregulate trade in cereals, edible oils, oilseeds, pulses, onion and potato, and stock limits for these will be imposed only in exceptional circumstances.

- A new central law will be formulated to provide barrier-free inter-state trade of farm produce and more freedom for farmers to sell directly or even online.

- PM Modi tweeted that the steps will “help the rural economy, our hardworking farmers, fishermen, the animal husbandry and dairy sectors” and “boost income of farmers”.

- The first two instalments of the stimulus programme announced on Wednesday and Thursday comprised schemes worth a total ₹8.4 lakh crore.

- Together with Friday’s Rs 1.5 lakh crore measures, the Rs 1.7 lakh crore package announced by the government in April and Rs 5.24 lakh crore support by the Reserve Bank of India, the measures add up to a total Rs 16.84 lakh crore, leaving a balance of Rs 3.16 lakh crore.

- Ashok Gulati, chair professor at Indian Council for Research on International Economic Relations: “The last three points announced by the finance minister on APMC reforms, contract farming and essential commodities are big, and will help farmers and consumers in the long run. They will also make the supply chain efficient.”

- The Rs1.5-lakh-crore package seeks to strengthen farm gate infrastructure and logistics for the sector and build capacities for intervention if needed.

- FMCG major ITC Ltd, which has deep engagement with farmers, welcomed the announcements.

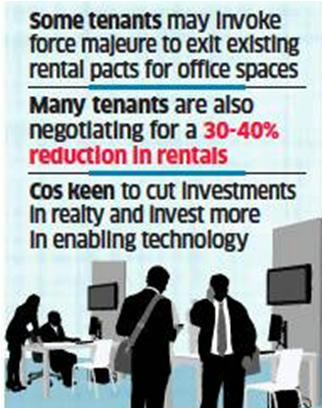

Office Realty

- Work from home (WFH) may have a big negative impact on India’s commercial real estate, with perhaps half-a-million sq ft of office space getting vacated.

- This will likely be a big blow to a sector that had seen substantial investment activity in pre-pandemic months.

- Some of India’s top professional services firms and companies in information technology (IT) space are considering surrendering a part of their rented office space as they look to implement work from home for their employees even post lockdown.

- These companies say that even when they open up post lockdown, about 25-50% of their executives will continue to work from home, directly impacting their need for office space.

- This will be over and above postponing negotiations for more office space.

- Among large banks Axis Bank is working on a plan to implement regular work-from-home guidelines for 2-3 days of the week.

Lockdown 4.0

- India is likely to extend the nationwide lockdown for another two weeks after May 17.

- Continuing to ease restrictions and possibly allowing public transport and reopening of restaurants and shopping malls subject to certain conditions.

- States and Union Territories may get further leeway to define containment zones and allow permitted activities in non-containment zones

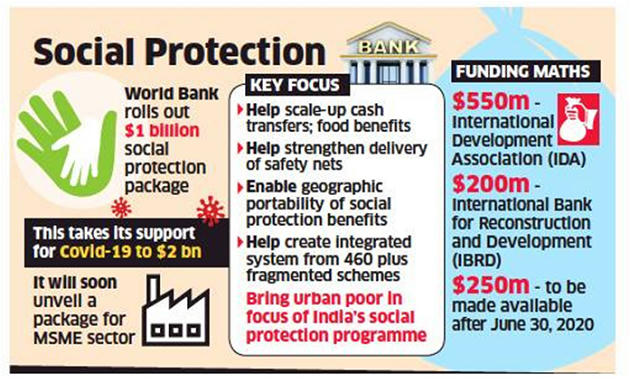

WB Clears $1b More for India

- The World Bank announced on Friday a social protection package of $1 billion (₹7,580 crore) for India.

- This will help the government scale up the platforms for cash transfers and delivering food benefits to the urban poor.

- The bank had in April unveiled a $1billion package for the health sector and will soon announce another for the micro, small and medium enterprises, as part of its Covid-19 support programme for India.

- “This programme will support India’s efforts towards a more consolidated delivery platform — accessible to both rural and urban populations across state boundaries,”

- WB said cash transfers and food benefits would help the poor and vulnerable access a “safety bridge” towards a time when the economy would start to revive.

MAKE IN INDIA

- India has drawn up a list of ten mega clusters across nine states as the most attractive destinations for companies to set shop based on sectoral requirements and tax incentives to promote the country as an alternative business continuity plan destination amid the ongoing Covid-19 pandemic.

- While the Noida-Greater Noida cluster is an electronics hub, Hyderabad is the largest export hub for pharma and vaccine, as per the analysis and these “have the potential of developing into the most fertile grounds for manufacturing rapid economic activity in the country.”

- Ahmedabad, Vadodara (Bharuch-Ankleshwar Cluster), Mumbai-Aurangabad, Pune, Bengaluru, Hyderabad, Chennai and Tirupati-Nellore are the other most attractive clusters for investors.

- This is part of the exercise that Invest India, the country’s national Investment Promotion and Facilitation Agency under the commerce and industry ministry, with professional services firm JLL undertook to create a guide for potential investors on how quickly they can invest in the country with low capex models to operate here.

- It highlighted India’s three distinct advantages-

- The recent reduction of corporate taxes for setting up of new industries

- Being host to Global In-house Centres and Global Centre of Excellence (GCo-Es) for several manufacturing companies.

- The added attraction of a large domestic market.

- The idea is to market Brand India at a time when the country’s FDI inflows fell 1.44% on year to $10.67 billion in October-December FY20.

- These 10 mega clusters cover about a hundred popular industrial parks and house over 600 Indian and foreign multinational companies.

- India currently has an inventory of around 22 million square feet of ready built industrial space in eight top cities ready to be occupied in six to eight weeks.

- Highlighting higher capex savings while operating in India, they said that rented factories for lease tenure of nine years and above can reduce the spend on land and building significantly, bringing down capital investment in the short term.

Covid, Job Fears

- The Covid-19 pandemic is causing increased panic attacks among India’s working professionals, say psychiatrists and mental wellness therapists.

- Fear of the coronavirus infection and death as well as anxiety over the economic uncertainty and possibility of job loss are the main likely triggers for this, according to them.

- Many are also calling up as they are feeling cooped up inside their houses and have been forced to follow a very different and isolated lifestyle.

Download Free PDF

WhatsApp

WhatsApp