Table of Contents

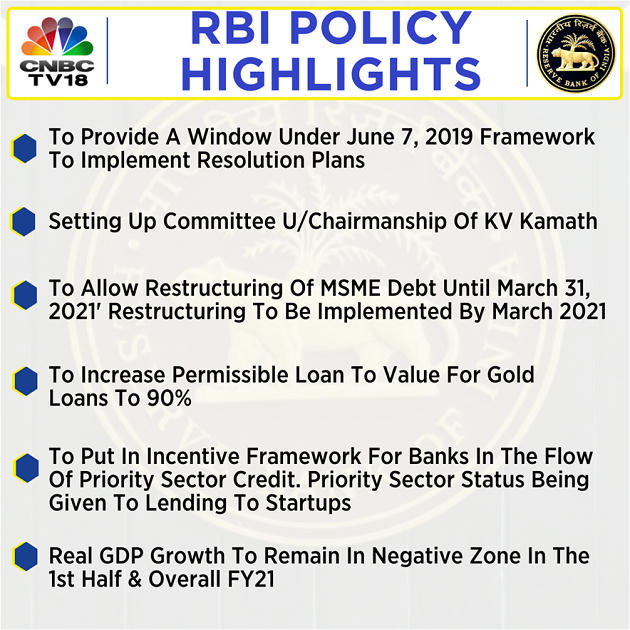

- Reserve Bank of India (RBI) has formed a five member committee under the chairmanship of former ICICI Bank CEO KV Kamath.

- Other members of the committee are-

- Diwakar Gupta,

- TN Manoharan,

- Ashvin Parekh,

- Sunil Mehta.

- More members may be added to the committee if required, RBI said.

Role of committee?

- The committee, which has been constituted by the RBI will make recommendations on-

- The required financial parameters to be factored into the resolution plans

- (with sector specific benchmark ranges for such parameters), Will submit its recommendations to the RBI.

- A resolution plan is a proposal that aims to provide

- A resolution to the problem of the corporate debtor’s insolvency and its consequent inability to pay off debts.

- The central bank will then notify the same along with modifications, if any, in 30 days.

Any threshold?

- The Reserve Bank of India (RBI) has set an aggregate exposure threshold of ₹1,500 crore and above

- For the process validation of resolution plans

- How to ensure these resolutions are of only COVID related stressed assets?

- Only those borrower accounts will be eligible for resolution (under this framework)

- Which were classified as standard, but not in default for more than 30 days with any lending institution as on March 1, 2020.

Other conditions

- The resolution plan can be invoked any time till December 31, 2020 and will have to be implemented within 180 days from the date of invocation.

- Under the framework,

- The lending institutions may allow extension of the residual tenor of the loan, with or without payment moratorium, by a period of not more than two years.

- The underlying theme of this resolution window is preservation of the soundness of the Indian banking sector, Das said.

Latest Burning Issues | Free PDF

WhatsApp

WhatsApp