Table of Contents

3rd Booster Package

- It is welcome that the government keeps up the momentum of its efforts to shore up flagging growth.

- In market, sentiments matter

- Finance minister Nirmala Sitharaman’s third booster shot for the economy

- Housing package worth ₹20,000 crore

- Export package worth ₹50,000 crore

- Export package: Remission of Duties or Taxes on Export Products (RoDTEP)

- It is claimed to be World Trade Organisation-compliant

- It will reimburse taxes, duties and cess on petroleum products and electricity and other embedded nonGST levies that add on to the value of the export.

- Funds from a special facility of ₹20,000 crore would be available to housing projects, provided

- The projects have not defaulted on payments and, thus, have not become non-performing assets or been referred for bankruptcy resolution

- These are at least 60% complete

- Each home in the project costs less than ₹45 lakh

- A loan that is satisfactorily serviced for a project that is 60% complete should qualify for regular financing; why does it need a special facility?

- In fact, a significantly larger special facility is needed to take over and complete projects that have defaulted on loans and are stuck.

Merger of NRI & FPI Routes

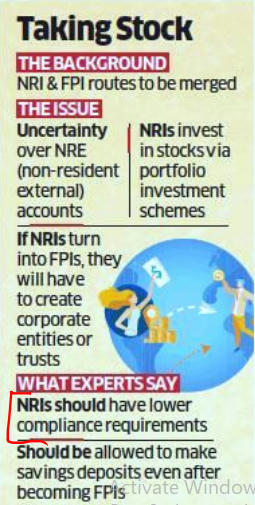

- The government plans to appoint a high-level committee to look into merging the non-resident Indian (NRI) and foreign portfolio investor routes.

- Finance minister Nirmala Sitharaman had announced in the July budget that the investment avenues would be merged to give NRIs seamless access to Indian equities.

- Currently, NRIs can open rupeedenominated NRE accounts for savings and fixed deposits while FPIs can’t.

- RBI had expressed concerns: NRE accounts hold deposits of about $93 billion (₹7 lakh crore).

- FPI regime is designed for institutional investors while the NRI are typically individuals.

Online shopping drops

- Consumer spending on online shopping sites is estimated to be down by about a fifth.

- Etailers have cut discounts and the growth slump has hit buying sentiment across sectors.

- Consumers seem to be cautious and taking their time before making purchases.

SAUDI DRONE STRIKES

- Indian refiners do not see an immediate disruption in crude supplies.

- Prices may witness a short-term spike.

- The drone attacks by West Asian rebel groups have hit 5.7 million barrels per day of production, which represents nearly half of the kingdom’s output and 6% of global crude supplies. Courtesy: BBC

India-US

- Possibility of a meeting between Prime Minister Narendra Modi and US President Donald Trump.

- On the sidelines of the UN General Assembly session.

- Both nations are keen on building on the progress made at two earlier meetings this year that gave impetus to strategic, trade and technology partnership.

Q1 If Mr Modi and Mr Trump will meet at sidelines of UNGA, it will be their 3rd meeting this year. Which were first 2 meetings?

- Japan & France

- UK & China

- India & France

- UAE & Japan

- Besides addressing the UNGA on September 27, Modi will also be part of the UN Secretary General’s climate meet and hold bilateral meetings with other leaders.

- On September 22, Modi will attend an Indian community event in Houston and meet top executives from the US energy sector.

- India wants to import more hydrocarbons from the US besides investing in its oil sector.

- There are reports that Trump could join Modi at the Houston rally.

- Afghanistan-Pakistan region

- Bilateral trade,

- Gulf situation

- Energy ties

- Partnership in technology

Life without Plastic

- Prime Minister Narendra Modi has called for a mass movement against single-use plastics from October 2

- Goldman Sachs, Infosys, Flipkart, Samsung, RPG Group, Mahindra Group and Godrej Group have been experimenting with different methods to reduce single use plastics, be it in their cafeterias; eliminating the use of plastic bottles, stirrers and cutlery; or through waste segregation.

- Plastic-waste management rules of 2016 stipulate that companies which use plastics or styrofoam as packaging must reduce the use of such materials and find ways to replace those with eco-friendly alternatives within four years.

- They also must have arrangements to take back the plastics they have sent into the environment in the form of products or packaging materials.

Carpooling

- The road transport ministry has firmed up draft guidelines for ride-sharing by private car owners.

- The Centre wants to ensure that carpooling is done on a no-profit, no-loss basis.

- Pooling by private vehicle owners will be allowed only through mobile apps.

GST rate cut will not help

- GST is a destination-based consumption tax

- It is levied throughout the value chain.

- The incidence of which is borne ultimately by the end-consumer.

- The lower the GST rate, the lower the incidence of the tax, and the lower the price paid by the final consumer for a particular commodity or service.

- GST rates on various products—such as automobiles and cement, among others—to give a boost to the economy and getting back to the higher GDP growth track.

- It does not guarantee growth.

- The bigger challenge today is the slump in demand, and not high GST rates.

- Any further reduction in GST rates would push the economy towards a larger fiscal deficit.

- Post the implementation of the GST in July 2017, the government has proactively reduced GST rates on umpteen numbers of goods and services.

- Rather than totally exempting any goods or services from the GST, it is prudent to either categorise them in the lower bracket or “zero rate”

- The biggest plus point of zero rating over exempting is that the constituents in the value chain—such as manufacturers and traders—can claim full input tax credits, resulting into lowering of price for the final consumer.

- The tax-cascading effect is completely nullified, making the product less costly.

- The exemption granted to products works counterproductive for the Make in India initiative of the government, as businesses tend to import and sell rather than manufacture and sell.

- Time is opportune for the government to look at the zero-rating option for certain products and services for domestic consumption.

- The quantum of export of goods has to grow substantially so as to generate revenue for Indian companies and increasing the employment rate, thereby increasing spending by Indians.

- The Make in India initiative has to gather speed, and new investments, both domestic and foreign, need to be increased by further easing the norms for doing business in India.

- India needs to take quick steps to take full advantage of the ongoing trade war between China and the US.

- The tax and regulatory environment in the country has to be certain for businesses operating in an honest and diligent manner.

- The liquidity crisis haunting Indian businesses has to be addressed more aggressively than ever before.

Download Free PDF

WhatsApp

WhatsApp