Table of Contents

ABOUT THE INTERNAL WORKING GROUP

- An internal working group led by M K Jain was formed by RBI in February 2019.

- It submitted its report in September 2019.

- Its mandate was to provide recommendations on agricultural credit, especially the impact of farm loan waivers on state finances.

- The working group was to study 3 aspects:-

- Factors that drive agricultural credit

- Building a cost-effective and inclusive credit system

- Enforcing credit discipline (impact of loan waivers on state finances and agricultural credit).

BACKGROUND

- Right at the time of RBI’s inception in 1935, it was felt that the central bank should pay special attention to agri credit.

- So, the RBI Act laid foundation to a special Agricultural Credit Department to study the problems and coordinate with the agencies concerned.

- Department was rechristened as the Rural Planning & Credit Department.

- Till date, there have been several committees and working groups to study and suggest measures to boost agri credit.

FINDINGS OF THE REPORT

- The ratio of agri credit outstanding to agri GDP increased from 0.6% in 1950-51 to 10% in 1971-72 and 22% by 1987-88.

- It was due to several policies such as 5-year plans, bank nationalisation, the bank branch policy and priority sector lending.

- But the ratio declined during 1991 economic reforms, which led to the start of Kisan Credit Card scheme in 1998.

- This coupled with other measures paid off as the ratio zoomed to the 50% level as of today.

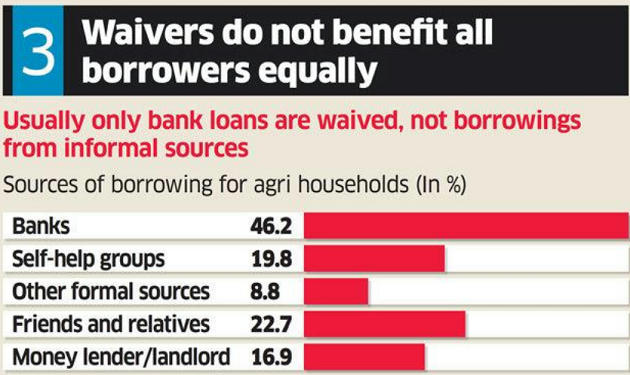

- Institutional source of agri credit with a mere 10% share in 1951, now reads 72%.

- So the main objectives of the committee is to suggest ways to increase the percentage of institutional finance.

RECOMMENDATIONS OF THE GROUP

- Digitise land records and make them accessible to banks for easier verification of collateral.

- Make a federal institution on the lines of the GST Council to take inputs from both the Centre and states.

- Banks should leverage technology in a major way and explore collaborations with agri-tech companies.

- For small and medium farms (SMFs), banks should not insist on land records for loans up to Rs 2 lakh.

- The committee also noted that there is a wide disparity across states when it comes to agri credit.

- The ratio of agri credit to state GDP is highest at 200% for Kerala and just 20% for the North-East and West Bengal.

OTHER RECOMMENDATIONS

- Rural Infrastructure Development Fund (RIDF) should be used as a tool to deepen credit absorption in these states.

- The RIDF, set up under NABARD in 1995, gets funds from commercial banks to make up for shortfall in priority sector loan targets.

- The report asked state governments to conduct awareness initiatives for land consolidation to achieve economies of scale.

- The working group favours DBT compared to interest subvention schemes.

- It proposed that the governments avoid waiver and instead make the existing policies more efficient.

- The Indian agriculture system is a maze with several ministries and organisations responsible for different tasks.

- Thus, any committee recommendations are often lost in the process.

- To avoid this, the Jain committee has marked out specific ministries and organisations against each suggestion, which is really helpful.

Latest Burning Issues | Free PDF

WhatsApp

WhatsApp