Table of Contents

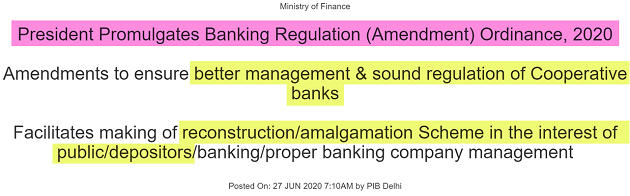

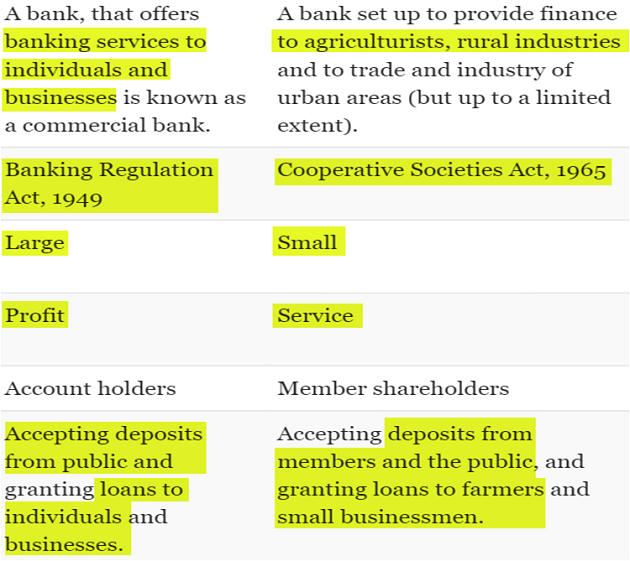

Commercial bank Vs Cooperative bank

- Interest rate on deposits in Cooperative banks are slightly higher

- Cooperative bank is governed by both banking and cooperative legislation, as they are registered under the Cooperative Society Act, 1965

- And regulated by National Bank for Agriculture and Rural Development (NABARD) & Reserve Bank of India (RBI).

- Banking laws were made applicable to cooperative societies in 1966 through an amendment to the Banking Regulation Act, 1949.

- Since then, banking related functions are regulated by the RBI

- And management related functions are regulated by respective State Governments.

- The amendments made to the Act will apply to-

- Urban co-operative banks & Multi-state co-operative banks

Main aim of the bill

- The Ordinance seeks to protect the interests of depositors and strengthen cooperative banks,

- By improving governance and oversight by extending powers already available with the RBI in respect of other banks

- The recruitment for the banks’ management will be based on certain qualifications.

- Appointment of the chief executive officer (CEO) will require prior permission from the banking regulator, as in case of other commercial banks.

- The audit of such banks will be as per the RBI guidelines.

- Also central bank can supersede the board, in consultation with the state government, if any co-operative bank is under stress.

- The Banking Regulation Act (amendment) Ordinance also enables cooperative banks,

- To raise money via public issue and private placement, of equity or preference shares and unsecured debentures,

- Subject to the central’s bank’s approval.

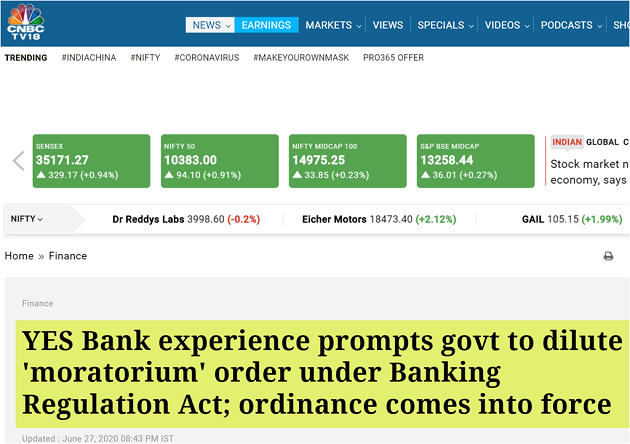

- The Banking Regulation (Amendment) Ordinance, promulgated by the President on Friday,

- Empowers the Reserve Bank of India to undertake revival plans for banks without imposing a moratorium to avoid disruption of the financial system.

- In case of Yes Bank, for instance, the government and the RBI first decided to put a moratorium which capped the amount of withdrawal by depositors.

- It was only after a few days that a new set of shareholders, led by SBI were put in the saddle.

- Over the years RBI has followed this practice.

What the ordinance does?

- The ordinance amends Section 45 of the Banking Regulation

- To enable making of a scheme of reconstruction or amalgamation of a banking company,

- For protecting the interest of the public, depositors and the banking system and for securing its proper management,

- Even without making an order of moratorium, so as to avoid disruption of the financial system.

Latest Burning Issues | Free PDF

WhatsApp

WhatsApp