Table of Contents

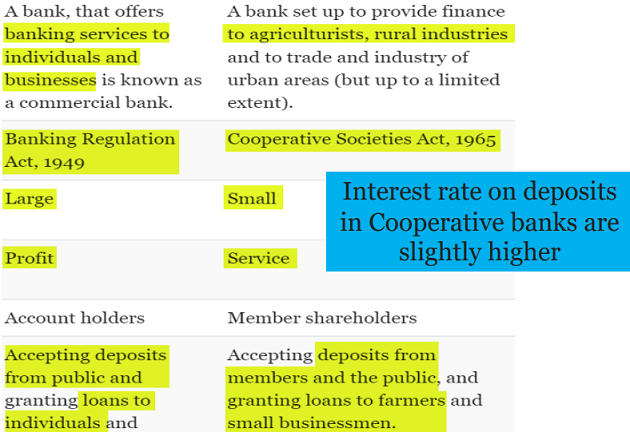

COMMERCIAL BANK VS COOPERATIVE BANK

- Cooperative bank is governed by both banking and cooperative legislation, as they are registered under the Cooperative Society Act, 1965

- And regulated by National Bank for Agriculture and Rural Development (NABARD) & Reserve Bank of India (RBI).

- Banking laws were made applicable to cooperative societies in 1966 through an amendment to the Banking Regulation Act, 1949.

- Since then, banking related functions are regulated by the RBI

- And management related functions are regulated by respective State Governments.

WHY NOT MUCH ATTENTION GIVEN TO THE FAILURES OF CO-OPERATIVE BANKS?

- Serious fraud investigations have invariably taken such long time that makes the system forget about the result and consequence of investigation with impunity.

- The Punjab & Maharashtra Co-operative Bank (PMC Bank) fraud is exposed in public which brought relief to the otherwise hapless numerous depositors and other stakeholders.

PRIMARY CREDIT SOCIETIES (PCS)

- Primary Credit Societies are formed at village or town level.

- It is basically an association of members residing in a particular locality.

- The members can be borrowers or non-borrowers.

- The funds of this society are derived from the share capital of the deposits and also the loans from central cooperative banks.

PCS TO UCB

- Urban cooperative banks (UCBs) are just primary credit societies (PCS) in the lexicon of cooperatives.

- These PCS get converted to banks under certain conditions and the Reserve Bank of India (RBI) provides them license.

- The joke of whole regulation commences from the stipulation that it is enough to have just a lakh of rupees to get such license.

- The rule remains unchanged for decades.

- How can one expect stability of an institution termed as bank with such low level of capital?

- Marathe Committee and Madhavarao Committee set up by the RBI have mentioned the need for raising the low level of capital required for such UCB.

- But why did not the RBI raise the threshold for decades is a matter for introspection.

LIQUIDATION PROCESS

- Liquidation proceedings of the closed banks is left to the Registrar of Cooperative Societies.

- From the day liquidation proceedings are issued, RBI washes off its hands.

DEMONETIZATION

- During demonetization and post demonetization UCBs harboured many depositors, whose origin was suspect but went fully protected.

ARE THERE NO GOOD UCB?

- There are strong Banks with good leadership following cooperative principles in letter and spirit like-Visakha Cooperative Bank, Gayatri Coop Bank.

- There could be a few more in other states.

- These few demonstrate that UCBs have a purpose to stay with confidence and inspiration for a good future.

CONCLUSION

- This is the right time to clean up the system.

- What needs to be done has to be done quickly.

- Regulatory intransigence has to be tackled firmly.

Latest Burning Issues | Free PDF

WhatsApp

WhatsApp