Table of Contents

Can India do a FTA with US/EU?

- India walked out of RCEP

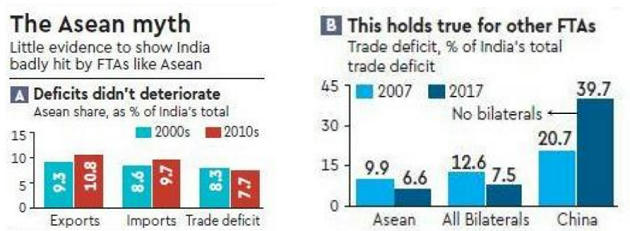

- Chinese imports will hurt India. Asean FTA is held up as an example of how FTAs are hurting.

- India’s interests are better served by concluding an FTA with the US or the EU.

- since both are higher-cost economies than India, India’s exports will also grow faster than, say, in an RCEP FTA. Asean FTA has hurt India is incorrect World’s fastest-growing region

- Countries in the RCEP are more competitive than India.

- They will continue to export more to the US/EU.

- 1990-2018: Vietnam’s overall exports grew 102 times versus just 18 for India—as a result, Vietnam’s exports are now 75% those of India’s.

- This makes it clear that the Asean FTA is hardly the issue.

- India’s lack of competitiveness is a factor that can’t be ignored.

- As India gets more inward-focussed—it has been raising import duties—it will get less competitive.

- What are we doing about our poor domestic policies?

- The sharpest deterioration in India’s deficit is with China, a country it has no FTA with; once again, FTAs are not the problem.

- There is a long gestation before any FTA gets actualised.

- Only about 16% of world trade takes place on a preferential basis.

- India has not even been able to resolve its dispute with the US on simple issues like duties on Harley Davidson motorbikes.

- It is not clear how soon India can sign an FTA with US/EU.

- An FTA with India, along the lines of the TPP that the US was working on, will presumably be as stringent.

Labour laws

- Intellectual property protection (India will have to grant patents to a lot more US drugs as US rules are more liberal than India’s)

- Reducing sops to PSUs

- The need for unfettered market access to US firms

- If lobby groups like Amul could stop an RCEP, surely they will try and do the same when the US/EU want even more market access and have even larger subsidy levels?

- Since most Indian markets will have to be opened, other lobbies will also get active.

Economy under stress

- Weakness could stretch into the next fiscal.

- Green shoots of a recovery in key indicators — from industrial production, exports and corporate sales to non-food credit growth — are barely visible.

- Economists, who were earlier optimistic about a rebound in the September quarter itself, are now much less sanguine.

- Unlikely to be a V-shaped recovery despite a favourable base.

- Compression in the government’s capital expenditure has a multiplier effect.

- The recent sharp corporate tax cut will draw private investments only in the medium term.

- Apart from that things need to improve on land and labour fronts.

- Pronab Sen, former chairman of the National Statistical Commission, said: Rural distress is the root cause of faltering demand in the economy.

- GDP growth projections to 4.9% y-o-y (from 5.7%) in 2019 and to 6.0% (from 6.9%) in 2020.

- The recent steps taken by the finance ministry, including those for MSMEs, NBFCs/HFCs and exports, will certainly help but their positive impact will flow in only after a time lag.

Diesel demand drops

- India’s diesel demand has slowed down sharply.

- Sluggish economy

- Structural changes like gst-induced road transport efficiency

- Trucks being allowed to carry a bigger load

- Increased power supply

- Consumer preference for petrol vehicles

- Diesel makes up 40% of India’s total oil demand

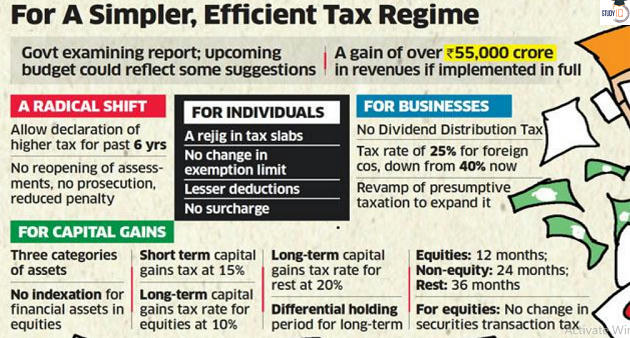

Income Tax task force report

- Govt revenue can boost by more than Rs 55,000 crore

- The report has suggested a radical shift to taxation approach.

- No prosecution or reopening of assessment for people who declare and pay higher income tax for a past period of up to six years with interest and 50 per cent penalty.

- The report has also suggested new income-tax slabs of

- 10%: up to Rs 10 lakh per year

- 20%: over Rs 10 lakh – Rs 20 lakh

- 30%: over Rs 20 lakh – Rs 2 crore

- 35%: for individuals earning more than Rs 2 crore

The current IT rates are

- % 5% + 4% cess: Rs 2.5 lakh – Rs 5 lakh,

- 20% + 4% cess: more than Rs 5 lakh up to Rs 10 lakh

- 30% + 4% cess: for those earning over Rs 10 lakh

- The task force has suggested removal of surcharge that ranges between 15- 37

50th WEF annual meet

- Over 100 Indian CEOs, several political leaders and select Bollywood stars including Deepika Padukone will be in the Swiss ski resort town of Davos.

- Discussion on what requires to make it a ‘cohesive and sustainable world’ .

- 2020 Theme: ‘Stakeholders for a Cohesive and Sustainable World

- ‘ 1971 forum’s first meeting: Business should serve all stakeholders -– customers, employees, communities, as well as shareholders.

- It was reaffirmed in 1973 in the ‘Davos Manifesto’, a document that has shaped the work of the WEF ever since.

Download Free PDF

WhatsApp

WhatsApp