Table of Contents

Leave Lending Rates to Competition

- The Reserve Bank of India’s direction to banks to link all new floating rate personal and retail loans, along with loans to micro and small enterprises (MSEs) to external benchmarks with effect from October 1.

- This might seem like a good way to accelerate the transmission of rate cuts to the end-borrower, but it is not.

- Moody’s Investors Service: it is credit negative for banks as it will limit their flexibility in managing interest rate risk.

- Different banks have different cost structures and different pricing power, and have to price their loans accordingly.

- It is far better to leave lending rates to competition among lenders and increase the potential competition by licensing more banks and giving a larger role to fintech companies.

- If banks have to lower their lending rates whenever repo rates go down, they have to either lower their saving deposit rates concomitantly or suffer an erosion of profits.

- Banks can formally comply with the RBI diktat on linking lending rates to an external benchmark by adopting a fat enough margin above the benchmark.

- Imagine the scenario when the repo rates start going up. Banks would have the freedom to raise rates within three months, in accordance with their external benchmark policy.

- Banks should be left free to set their lending rates, in accordance with their cost of funds and market conditions, apart from borrower profile.

- In reducing the number of public sector banks from 27 in 2017 to 12 now, the government has eroded potential competition among banks.

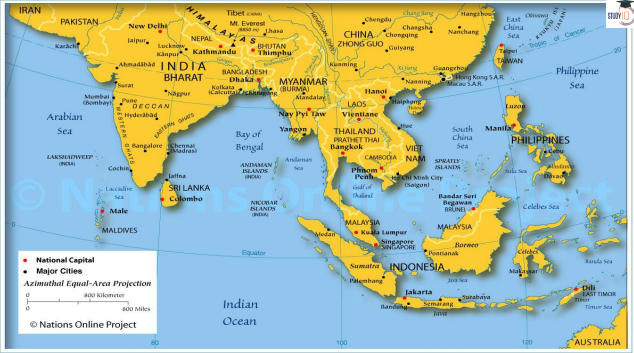

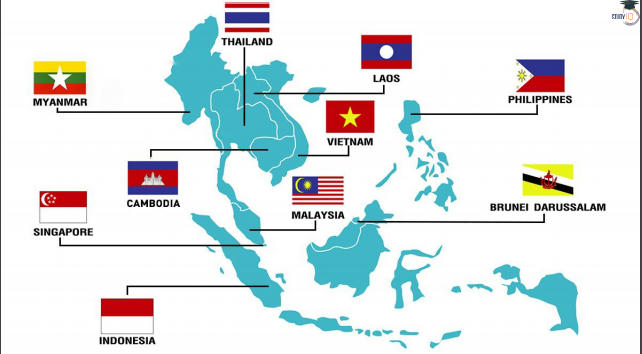

India-ASEAN FTA

- Association of Southeast Asian Nations (Asean) has agreed to India’s longpending demand to review the free trade agreement (FTA) between the two sides.

- India: it has not benefitted from the agreement.

- Goods trade deficit: $13 billion in FY18 $22 billion in FY19

- This will be the first review of the pact that came into force in 2010.

- 16th Asean Economic Ministers (AEM)- India consultations.

- The services component, in which India has a greater interest, and the investment chapter are yet to be ratified.

- India-Asean FTA covers 75% of the two-way trade.

- India kept around 10% of tariff lines in exclusion.

- The surge in goods imports into India is accentuated by instances of nonadherence to origin norms and lack of full cooperation in investigating and addressing such breaches.

- If RCEP comes into force, then the member countries will have to offer steeper tariff concessions.

India-US talks

- Restoration of Generalised System of Preferences (GSP).

- Mutual withdrawal of their disputes at the World Trade Organization

- Removal of higher tariffs on steel and aluminium by Washington

- Work to resolve their bilateral trade differences

- Last year, US levied global additional tariffs of 25% and 10% on the import of steel and aluminium products, respectively.

- India responded by levying retaliatory tariffs on 28 products originating or exported from the US with effect from June 16, for which Washington dragged it to dispute at WTO.

- Talks collapsed after the US withdrew incentives to $6.3 billion of Indian exports under the GSP programme effective June 5.

- Commerce minister Piyush Goyal is also likely to visit Washington soon.

- Prime Minister Narendra Modi is travelling to the US later this month to attend the UN General Assembly.

Kuwait royalty

- Prime Minister Narendra Modi is planning to host a high-profile member of Kuwait’s ruling family.

- Kuwait has been one of the oldest partners of India in the Gulf region.

- Minister of State for External Affairs V Muraleedharan’s visit to Kuwait next weekend could help firm up the contours of the trip.

- Emir Sheikh Sabah al-Ahmad al-Jaber alSabah visited India in 2017 in his personal capacity, it was way back in 2006 that he had visited New Delhi in his official capacity.

- India is also hoping to attract Foreign Direct Investment from Kuwait.

- Oil-rich Kuwait is planning to double investments in India from the current $5 billion, taking advantage of the country’s growth story, and is also exploring thirdcountry joint projects with New Delhi.

Infra spending

- The government will frontload infrastructure spending in a bid to give the economy a boost and announce one or two more sets of stimulus measures aimed at reviving growth in the coming quarters.

- Today the economy needs money. There should be consumption increase because of government spending money.

- The government has announced a plan to spend Rs 100 lakh crore on infrastructure in the next five years.

Download Free PDF

WhatsApp

WhatsApp