Table of Contents

Aatmanirbharta of agriculture

- We have a population of 1.37 billion.

- We have to produce most of our food at home.

- Mid-1960s we used to be in a “ship to mouth” situation

- There is a political price we have to pay for over-dependence on food aid.

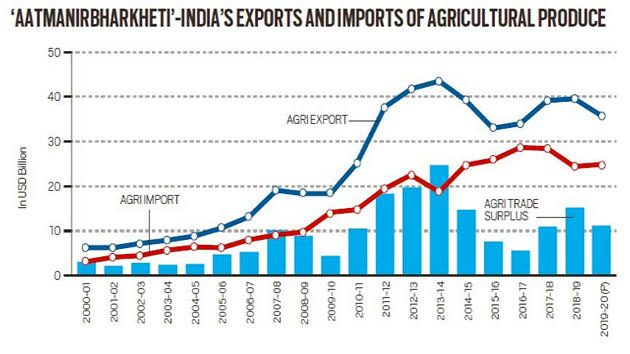

- In last 10 years, India has been a net exporter of agri-produce.

- 2013-14 was a golden year for agri-trade: exports peaked at $43.6 billion while imports were $18.9 billion, giving a net trade surplus of $24.7 billion.

- Agri-exports have been sluggish and sliding

- 2014-2019: agri-exports were just $36 billion, and the net agri-trade surplus at $11.2 billion.

- Judging by the above given figures, it looks like doubling agri-exports by 2022 is almost impossible.

- We need to keep in mind the principle of “comparative advantage”.

Agri-export basket of 2019-20

- Marine products $6.7 billion

- Rice $6.4 billion

- Spices $3.6 billion

- Buffalo Meat $3.2 billion

- Sugar $2.0 billion

- Tea-Coffee $1.5 billion

- Fruit-Veg $1.4 billion

- Cotton $1.0 billion

- Rice and sugar are subsidised through free power and fertilisers.

- Per hectar basis, total 10-15% of the value of rice and sugar produced, is subsidised.

- Virtual export of water

- One kg of rice requires 3,500-5,000 litres of water

- One kg of sugar consumes about 2,000 litres of water

- Almost 75% of the nitrogen in urea is not absorbed by plants.

- Why don’t we offer similar incentives for exports of high-value agri-produce?

- Agri-imports front, the biggest item is edible oils worth about $10 billion.

- This is where there is a need to create “aatma nirbharta”.

- Create competitive advantage

- Augmenting productivity and increasing the recovery ratio of oil from oilseeds.

- While mustard, sunflower, groundnuts, and cottonseed have a potential to increase oil output to some extent, the maximum potential lies in oil palm.

- OIL PALM is the only plant that can give about four tonnes of oil on a per hectare basis.

- India has about 2 million hectares that are suitable for oil palm cultivation — this can yield 8 mt of palm oil.

- But it needs a long term vision and strategy.

14 INDICATORS

- Economic Affairs Secretary Tarun Bajaj: “We are monitoring 14 parameters on a weekly basis to see the change”

- Contraction has come down.

- E-way bills, GST collections and exports were on the rebound

- Government is looking to road and railway projects, which can have a spin-off effect, to play a key role in revival.

- NHAI plans to attract Rs 50k crore via SPV.

- Railway privatisation (trains) and station redevelopment.

- Govt. has already cleared 70 projects worth ₹8,000 crore under SWAMIH (Special Window for Affordable and Mid-Income Housing).

- SWAMIH will provide last-mile funds for stalled housing projects.

- The government will exit non-strategic sectors.

- Credit bguarantee scheme for MSMEs

- Reforms in sale of farm produce

‘Governance in commercial banks in India’

- The recent RBI discussion paper.

- It seeks to bring about path-breaking reform in private sector, nationalised and regional banks.

- It proposed board-led oversight and evaluation structures for compliance, risk-taking, internal audit and vigilance, so as to proactively boost governance standards in Indian banking.

- The balance of power between the board and the chief executive officer (CEO) will shift in favour of the former.

- Selection of board members and their compensation.

- Board of directors of a bank comprise not less than six directors and not more than 15, with independent director accounting for a majority.

- Chief risk officer and chief compliance office report to the risk management committee of the board.

- Head of internal audit and the chief of internal vigilance would perform under supervision of the audit committee of the board.

- And both the risk committee and the audit committee of the board would consist of only non-executive directors (NEDs).

- Further, a nomination and remuneration committee of the board is also proposed, and which again would be made up of only NEDs.

- And the performance of the NEDs would be evaluated by the entire board, minus the concerned NED.

- Surely, there’s a solid case for an outside agency to monitor board performance as well.

- The regulation of bank bonuses by RBI seems to be a work in progress.

- Discussion of bank governance reform would be incomplete without discussion of banking supervision reform, on which there is little clarity.

Download Free PDF

WhatsApp

WhatsApp