Table of Contents

Labour Laws

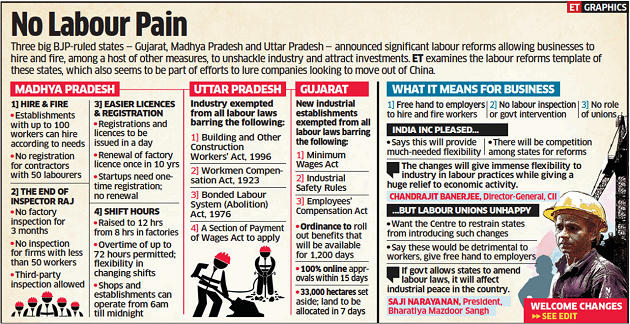

Welcome Changes To Labour Laws

- We welcome the move by BJP states Uttar Pradesh and Madhya Pradesh — with Gujarat seeking to follow suit via an Ordinance — to temporarily suspend the operation of labour laws, to help production struggle its way out of the hole in which it finds itself in the wake of seven weeks of lockdown.

- India had 45 labour laws at the level of the Centre and about 200 labour laws at the level of the states.

- Till the Modi government decided to streamline the central laws into 4 codes on industrial relations, wages, social security and occupational safety.

- The last three have been legislated into law, while the first one remains a work in progress.

- The current move must be seen as an earnest governmental effort to revive the economy and breathe some life into the animal spirits that have gone into a swoon.

- Labour is a concurrent subject, in which the Centre and the states can make laws.

- Where there is any conflict between a central law and a state law on the same subject, the central law will prevail.

- Madhya Pradesh has done well to let shops stay open from 6 am to 12 midnight.

- Keeping shops open longer is the only way to prevent crowding of shoppers.

Fresh Air

- Lockdown and a dramatic reduction in air pollution.

- Air pollution in north India has dropped to a 20-year low.

- Harvard University study establishes a correlation between long-term exposure to air pollution and Covid-19 mortality.

- The study finds that people living in polluted cities are more likely to have compromised respiratory, cardiac and other systems — and, therefore, are more vulnerable to Covid-19.

- Clean air and the right to breathe must be available to all citizens.

- ECONOMIC REVIVAL PACKAGE can get India to this Green Frontier.

- New investments could be directed towards renewable energy, with larger allocations and subsidies to initiatives like the National Solar Mission.

- Large electric battery factories could be established to enable localised energy storage solutions.

- Bailouts and incentives to the auto, aviation and construction sectors could encourage green transitions and clean air ambitions.

- Global experience suggests that crisis create political opportunities for embracing change.

- After the 2008 global financial crisis, China spent nearly a third of its $568 billion stimulus towards projects that addressed environmental goals.

- China has since become a global leader in solar, wind and hydropower markets.

- Warming climate may well be the single-biggest macro shock the world will have to face.

- India is already the third-largest emitter of greenhouse gases (GHGs).

- Our emissions will nearly double in the next decade or so.

- Public and private funds need to be redirected to green investments.

- The battle for clean air requires structural reforms across multiple sectors, institutions and processes.

Govt to Borrow ₹4.2 lakh cr More in FY21

- The government has raised its gross market borrowing target for the current financial year to ₹12 lakh crore from ₹7.8 lakh crore estimated in the budget.

- Combination of lower tax collections and the fiscal stimulus needed to support the economy.

Moody’s

- Moody’s Investors Service had predicted 2.5% growth for India in FY21 in March.

- May 2020: India’s economy will not grow in the current financial year.

- FY22: bounce-back to 6.6% growth

- It reaffirmed India’s Baa2 rating with a negative outlook, indicating a credit upgrade was unlikely in the near term, as it estimated a fiscal slippage of up to two percentage points to 5.5% of GDP against the budgeted 3.5%.

India Inc Panel

- A panel led by Mahindra & Mahindra managing director Pawan K Goenka and comprising members from leading business groups, has begun identifying industries to propel India’s manufacturing in a post-pandemic world.

- The committee is expected to draw up strategies to boost industrial growth in at least 12 sectors, including steel, agro-chemicals, food processing, aluminium, electronics and textiles.

- The special panel, set up with support from DPIIT.

- Government moves to put in place a single window for all business activity, in partnership with states.

- The panel will look at industries that aid domestic growth with a focus on exports to achieve world dominance.

- India’s eight infrastructure sectors contracted the steepest in nearly eight years in March after touching an 11-month high in February.

- Independent economists expect industrial production for March to contract by 15-40%.

- Various industry chambers will draw up strategies for at least three sectors each and submit the reports, especially as countries seek to replace China-made products with those from other sources.

- The CII will submit a report on agrochemicals, steel, food processing and aluminium, while the Federation of Indian Chambers of Commerce and Industry would work on textiles, electronics and furniture.

Corporates Seek ₹15L Cr Stimulus

- CII: immediate stimulus of around ₹15 lakh crore

- This accounts to 7.5% of India’s GDP

- By the time the third phase of the lockdown ends on May 17, the Indian industry would have lost two months of output.

- With economic activities being restricted for over 50 days now, the negative impact on the economy is expected to be even more significant than what we had earlier anticipated.

- To support the estimated 63 million MSMEs, the industry body has suggested a credit protection scheme for MSMEs, whereby 60-70% of the loan should be guaranteed by the government.

Download Free PDF

WhatsApp

WhatsApp