Table of Contents

Deal for Cane Farmers

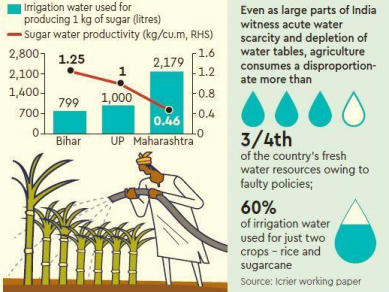

- A government panel is considering recommending special incentives to dissuade farmers from growing sugarcane in water-scarce areas.

- Ever-rising fiscal burden

- Depletion of water tables Task force headed by NITI Aayog member Ramesh Chand

- An incentive of Rs 6,000/acre for farmers in a year to not grow cane in states like Uttar Pradesh and Maharashtra.

- Idea: bring down area under sugarcane cultivation by about 20%

- On an average, over 48 lakh hectare of cultivable land has been under sugarcane farming in the last five years.

- The reason for farmers in water-scarce regions sticking to sugarcane farming is the support prices, assured market and profitability ensured by the Centre and state governments.

- Objective: shifting water intensive crops to regions where the natural resource is abundant.

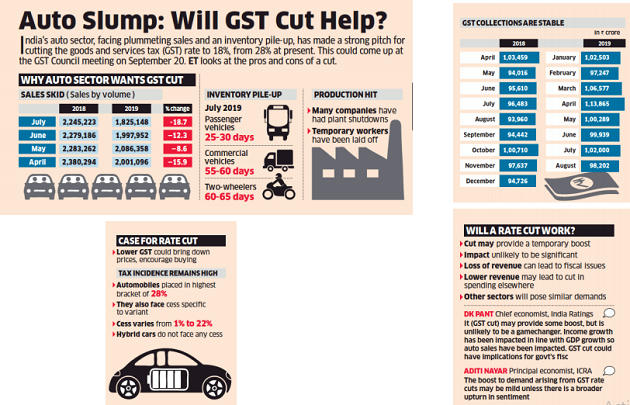

GST on Auto

- Good and Services Tax (GST) Council meets in Goa on September 20.

- Heightened expectations: Council will cut the tax rates for a host of categories of automobiles.

- Revenue authorities at the central and state level are concerned about the potential revenue loss.

- Automobiles including two-wheelers, attract 28% GST, they also are subjected to cesses that vary from 1- 22% depending on the make of the vehicle.

- If GST is reduced from 28% to 18%: government’s GST revenue could take a hit of at least Rs 30,000 crore.

- This takes into account gains from the push to sales volumes once taxes are cut.

- GST Compensation Act doesn’t allow cesses on products that are not placed on the highest slab.

- The compensation proceeds are vital for states that are by law guaranteed a 14% year-on-year rise in GST revenue till 2022.

Q) At present, GST rate for electric vehicles is?

- 0%

- 5%

- 12%

- 18%

RCEP Meet

- Pressure mounts to conclude the deal this year.

- RCEP members have asked India to decide if it wants to remain a part of the proposed trade grouping.

- Talks were on for India to immediately eliminate tariffs on 28% of the traded goods and more than 35% of the goods in phases.

- Piyush Goyal attended the plenary session of the 7th RCEP Ministerial Meeting in Bangkok.

- RCEP has said developments in the global trade environment may affect their individual positions as talks reach a “critical milestone.

Bharat Net

- Aims at connecting 2.5 lakh gram panchayats with wired broadband connectivity at 100 Mbps speed.

- Government’s showpiece project related to Digital India.

- FE recently visited Dhanauri Kalan panchayat in Gautam Budh district in Uttar Pradesh, which has been earmarked as a Digital Village inaugurated by communications and IT minister Ravi Shankar Prasad last year, but the services did not look encouraging.

- Although the panchayat was connected with optical fibre in 2016-end under the phase-I of the BharatNet project, 100 Mbps speed is still not available to consumers in Dhanauri Kalan.

- The only Common Service Centre (CSC) at the panchayat, which provides home broadband connections as well as acts as a centre where citizens can access Internet on computers for their various needs like taking printouts or applying online for various schemes, is also facing peculiar problems.

- The Internet remains down for several hours for days due to some cable cuts which happens quite frequently.

- The cables and Internet are provided and maintained by BSNL.

- Speed is only 2 Mpbs, which is much lower than what is being provided by Reliance Jio’s mobile services.

RoSCTL

- Government aims at administrative easing to boost exports and domestic manufacturing.

- Government is contemplating a revamp of the Department of Commerce and certain incentive schemes that fall under it.

- New exports incentives scheme — Rebate of State and Central Taxes and Levies (RoSCTL)

- RoSCTL is a replacement of the DGFT’s Merchandise Exports from India Scheme (MEIS), which was challenged by the US last year for violating global trade rules.

- There is a feeling that making the revenue department solely responsible for these schemes will help in ease of doing business and reduce transaction time for exporters.

- Biswajit Dhar, professor, Jawaharlal Nehru University: “Any such move will only pit ministries against each other because while the finance ministry looks at revenue foregone, export targets and exporters’ concerns are the commerce department’s responsibility. ”

Download Free PDF

WhatsApp

WhatsApp