Table of Contents

Nirmala Sitharaman

- CSO said the country’s grew at a 25- quarter low rate of 5% in April-June.

- FM: government was responding to the issues confronting the economy “sectorally” .

- Govt’s approach: “every sector of the Indian economy, when it approaches us, we (the government) hear them out for solutions that they want and we respond to it”.

- National Sample Survey Organisation’s (NSSO) first annual survey on employment had indicated that joblessness in the country rose to a 45-year high in 2017-18 with the unemployment rate among the labour force at 6.1%.

- Country’s official jobs data always concentrated on the formal sector only.

- Informal sector employment has not been appropriately or exhaustively documented.

- GST rate reduction on vehicles: it has to go to the GST Council.

- Fears job losses due to mega merger of banks: Sitharaman said not even one employee would be removed following the amalgamation.

- There would not be any closure of banks and no bank was being asked to do something new.

GST collection slips

- August collection: ₹98,202 crore

- Lowest in the first 5 months of the current fiscal

- April-August average monthly collection: ₹1.02 lakh crore

- Average continues to be above the rate (Rs 99,083 crore) required to achieve the Centre’s Budget estimate for FY20.

Mudra Loans

- Launched by Prime Minister Narendra Modi: April 2015

- Aims: to offers loans to non-corporate and non-farm small/micro enterprises.

- some activities allied to agriculture — such as dairy, poultry and bee-keeping — are also covered under it.

- Shishu: up to Rs 50,000

- Kishore: Rs 50,000 and up to Rs 5 lakh

- Tarun: above Rs 5 lakh and up to Rs 10 lakh

- The finance ministry has asked staterun banks to review their Mudra loans.

- Aim: to launch a revamped version ofØ the scheme that is meant to finance small and budding entrepreneurs, amid fears of a spike in non-performing assets (NPAs) in these accounts.

- Mudra loan limit could also be doubled

- Mudra has improved the access to credit at affordable rates (8-12%)

- NPAs in Mudra loans jumped to 5.28% of the disbursement as of March 2019, against 3.96% a year earlier.

- The bad loan ratio is still much lower than banks’ total NPA level.

- Late last year, former RBI governor Raghuram Rajan warned that credit targets were sometimes achieved by abandoning appropriate due diligence.

They are listening

- Tech companies do listen to your conversations.

- Whistleblower in a Guardian report revealed.

- Tech giants’ argument: How can you have a smart AI, if you don’t feed it enough information to be “smart”.

- Google knows what you read, watch and where you go, comes from its amazing ability to track you.

- Instead of being discreet about their plans, apps and websites need to ask consumers to opt for such services, on the pretext of giving them earnings for a share of advertisement sales.

- That way, they may even find willing participants.

- As for the rest, there should be an option to opt-out.

Subsidized Batteries

- Expenditure Finance Committee (EFC), under the FinMin.

- FinMin has approved a Niti Aayog planØ to subsidise manufacturing of batteries for electric vehicles and mobile phones.

- Proposal: annual subsidy of Rs 700 crore

- EFC has given its go ahead

- 50 GWh (Gigawatt hours) battery capacity in the country.

- The proposal will now be sent to the cabinet for approval, following which the Aayog will invite bids in December.

- The plan is to award contracts soon after that so that battery manufacturing plants are up and running by 2022.

- Conservative estimates show that India would need 600 GWh of battery for 10 years starting 2020.

- Cost will come down in future

- Present: $276, or about Rs 19,800, per kilowatt hour (kWh)

- Expected: $76, or about Rs 5,450

- At present, batteries account for an average of 50% of the cost of electric vehicles in the country.

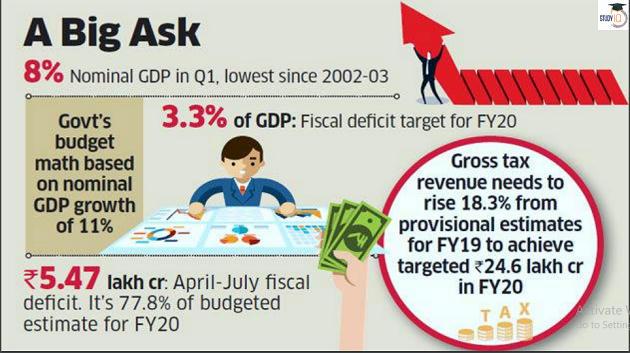

Fiscal deficit target

- The government may have tough time meeting its fiscal deficit target this fiscal following a sharp drop in the nominal gross domestic product in the first quarter as that would most likely mean muted tax collections as well.

- The government may now have to rework its fiscal arithmetic because the budget calculations are based on estimated nominal GDP growth of 11%.

- Budgeted fiscal deficit target for FY20 is 3.3% of GDP.

- Additional surplus transfer from the Reserve Bank of India (RBI) will provide some cushion for poor revenue collections, but there is not much room to offer any stimulus to economy.

- RBI will transfer about Rs 58,000 crore more than what the government has budgeted in FY20.

- Aditi Nayar, principal economist at ratings agency ICRA, said, “The steep targets enshrined in the FY20 budget relative to the FY19 provisional tax collections look increasingly difficult to achieve. ”

- Achieving the tax revenue and fiscal deficit targets would be challenging if growth did not improve significantly.

Modi Putin meeting

- 20th edition of an annual bilateral summit, Vladivostok

- Russian President Vladimir Putin will host Prime Minister Narendra Modi for a one-on-one dinner.

- Both sides are expected to ink 25 pacts across sectors

- Global issues including the Af-Pak hotspot.

- Russia was the first P-5 nation to support India’s recent moves on Kashmir.

- The proposed agreements will also cover education and culture which would increase the intake of Indian students in top Russian educational institutes.

- Spectre of investigations

- The Reserve Bank of India and the Enforcement Directorate are investigating several companies that have received investments from their foreign subsidiaries or affiliates on the ground that such fund flows could indicate possible roundtripping, said people in the know.

- ED: the agency that probes money laundering.

- The government amended the tax treaty with Mauritius in 2016, removing the tax arbitrage on capital gains.

- Under POEM rules, overseas subsidiaries are treated as domestic entities for tax purposes if they are controlled and managed from India.

Download Free PDF

WhatsApp

WhatsApp