Table of Contents

Merger Challenges

- Addressing the Ficci-Indian Banks Association banking summit in Mumbai Reserve Bank of India Governor Shaktikanta Das said…. “mood of doom and gloom is not going to help anyone”

- “I am not saying we maintain a Panglossian countenance and smile away every difficulty,”

- “But in any real economy, the mood is very important. There are several opportunities amid the challenges we face today and together with the financial sector, the business community, the policymakers and the regulators, we should address the challenges and look ahead with greater confidence.

- ” Central Statistics Office (CSO): GDP grew by just 5%, a 25-quarter low, during Q1 2019-20.

- The last time growth slipped to a comparable low was in Q1 2013, when the UPA government under Manmohan Singh was battling charges of ‘policy paralysis’ following the Comptroller and Auditor General (CAG) report on the coal block scam.

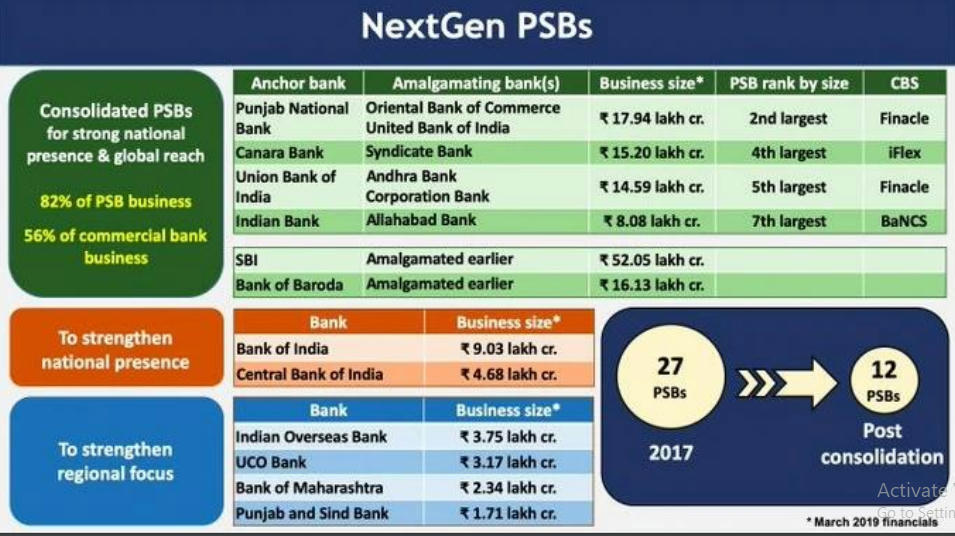

- Nirmala Sitharaman’s announcement of a mega merger of public sector banks (PSBs).

- Media attention was diverted from dismal growth numbers to bank mergers.

- 27 years ago Narasimham Committee saw merit in size of banks.

- 1993: Punjab National Bank (PNB) + New Bank of India

- Lessons from 2007-08 global financial crisis

- Large banks could pose systemic risks that endanger the entire economy.

- The benefits are highly questionable.

- But the pain and cost are real, and are likely to prove enduring.

- Particularly, timing of merger is most unfortunate.

- At a time when PSBs across the board should be focusing on revival of bank lending and recovery of bad loans, instead, be engaged in trying to see mergers through.

- Insolvency and Bankruptcy Code (IBC) process is yet to stabilise.

- The more important business of banking will take a back seat.

- Banks may take 2-3 years to standardise core technology, products and customer applications.

- Website, mobile apps, IVR — all have to get merged into one.

- Beyond technology integration, banks will need a better communication strategy.

- There are similarities, but there is uniqueness as well in terms of products

- The need of the hour is higher credit growth.

- Upfront recapitalisation of PSBs to the tune of ₹55,000 crore (out of ₹70,000 crore promised in the Budget) would have spurred credit growth with multiplier benefits for investment and growth.

- But that’s not going to happen if the bulk of the PSB universe is grappling with existential angst.

Automobile and GST

- Society of Indian Automobile Manufacturers

- (Siam) Siam sought immediate steps from the government, as sales continued to fall with passenger vehicle makers witnessing a decline of 30% offtake in August.

- Siam said even commercial vehicle and two-wheeler sales are significantly negative

Reduce GST rates from 28% to 18%

- This would significantly reduce the cost of vehicles and, in turn, create demand.

- The festival season is around the corner, it is imperative that these decisions are taken quickly and announced without delay so that the industry could hope for a better festival season that could harbinger a recovery in the industry.

- There is also an urgent need to come out with an integrated incentivebased scrappage policy covering all segments of the automobile industry as promised by the FM. The series of announcements on credit availability and reducing the cost of credit that were made do not seem to have percolated down to the nonbanking financial companies (NBFCs) which support the bulk of finance for the automotive industry.

Tax collection

- Tax department: record 49,29,121 tax returns were filed on August 31, the last day for filing returns for FY19.

- Certainly, it is true that a 42% jump in the number of returns filed in the last five days of August as compared to the same month last year is impressive.

- April-August performance is less impressive and just 4% more returns were filed so far.

What really matters is the amount of tax collected, not the number of returns filed.

- Tax collections fell dramatically short of targets in FY19, and have continued to do badly in the first four months of FY20.

- In April-July, at ₹5.4 lakh crore, total gross tax collection grew only by 6.6% as compared to the FY20 Budget target growth of 18.3%.

- Direct tax collection came in at ₹2.2 lakh crore, up 5.8% from a year ago.

- The budget estimate for direct tax mop-up growth is pegged at 17.4%. While corporate tax collections rose a mere 5.4%, personal income tax collections rose 6%.

- If GDP growth continues to remain sluggish this will hit tax growth even more.

- Tax-compliance is still very poor.

- Direct Taxes Code recommends cutting of tax rates.

- After a zero tax for those earning up to ₹5 lakh, for instance, the tax rate jumps to 20.8% for those in the ₹5-20 lakh income bracket.

- Just 81,344 individuals reported earnings of more than ₹1 crore

- Price research agency: number of those earning over ₹1 crore at around 6.4 lakh in FY16 11.6 lakh persons who earn ₹50-100 lakh a year but just 1.4 lakh persons declared this to be their income in FY16.

- If tax rates are more reasonable, the chances of higher tax collections are greater.

Legacy dispute resolution scheme

- The government expects a windfall of Rs 16,000-20,000 crore from the legacy dispute resolution scheme for indirect tax cases.

- Scheme was announced in the Budget and will run from September 1 to December 31.

- Rs 1.5 lakh crore of revenue demand was stuck in erstwhile indirect tax (excise, service and customs) litigations in various forums at the end of FY18.

- As per an estimate, even if half of this amount gets channelled into the scheme, the government could garner over Rs 15,000 crore.

- The scheme provides substantial relief in tax dues for all categories of cases as well as full waiver of interest, fine, penalty.

Fitch Solutions

- After slumping to an over six-year low, India’s economic growth will pick up over the coming quarters but the rebound is expected to be weaker than before.

- It trimmed GDP forecast for the current fiscal to 6.4 per cent from 6.8 per cent previously.

- The combination of fiscal and monetary stimulus, continued reform momentum, and favourable base effects would lead to a rebound in growth, it said.

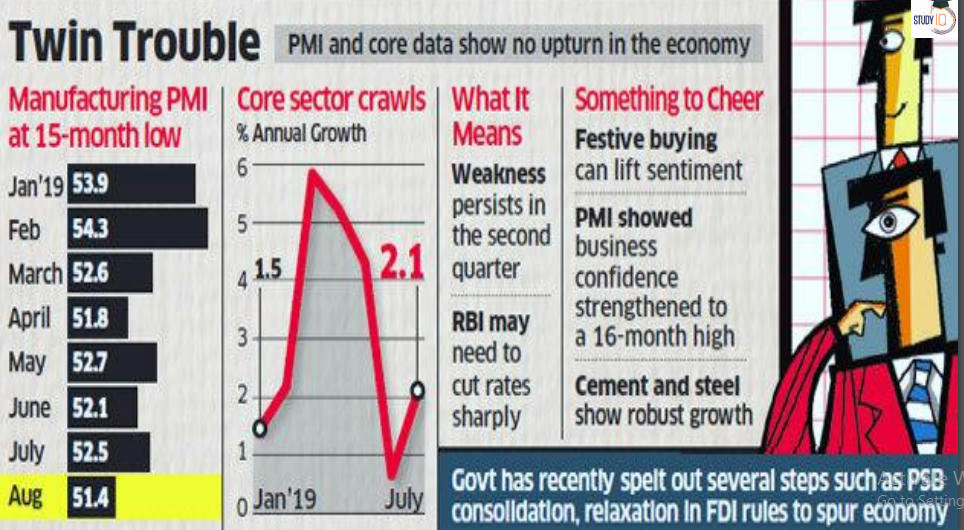

August PMI manufacturing

- Manufacturing activity in India slumped to a 15-month low in August.

- Private finders say sales slowed, forcing factories to cut back on production.

- Government numbers showed muted output rise in the infrastructure sector in July.

- Both demand and investment is slow.

- Purchasing managers’ index: 51.4 in August

- 52.5 in July

- Below its long-run average of 53.9.

- 50-point mark separates expansion from contraction.

Eight core sectors growth slows

- Growth in core sector activity quickened in July 2019 to 2.1%, due almost entirely to a recovery in the cement sector.

- The Index of Eight Core Industries had grown at just 0.7% in June 2019.

- However, July’s growth rate is far lower than the 7.3% growth registered in the same month last year.

- Electricity Steel Refinery products Crude oil Coal Cement Natural gas Fertilizers

Download Free PDF

WhatsApp

WhatsApp