Table of Contents

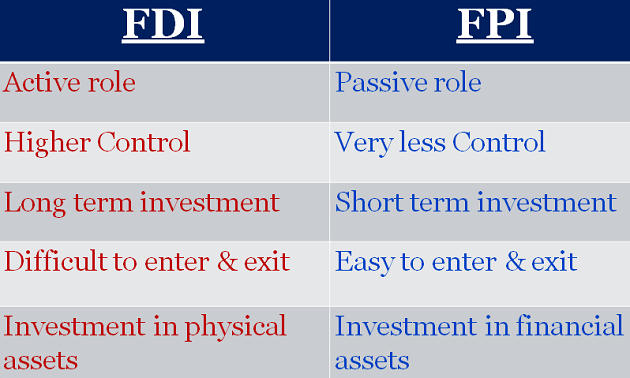

FDI VS FPI

- When investment is made with an intent of obtaining an ownership stake in a foreign country- FDI.

- In FDI investment is done through transfers of funds, resources, technology etc.

- When the investment is made in the financial assets of a company in foreign country- FPI.

- In FPI investment is done through stock, bonds, etc.

INCREASE IN SHORT TERM INVESTMENT

- According to the current norms,

- Short-term investments by a foreign portfolio investor (FPI) should not exceed 20% of the total investment of that FPI in DEBT

- The short-term investment limit has now been increased from 20% to 30%

- RBI has also made relaxation in the voluntary retention route (VRR) for FPI investments in debt.

VOLUNTARY RETENTION ROUTE (VRR)

- In March 2019, The RBI introduced a separate channel, the ‘Voluntary Retention Route’ ,To enable FPIs to invest in debt markets in India.

HOW IT IS BENEFICIAL TO INVESTORS?

- Investments through VRR are free of- Macro-prudential and other regulatory prescriptions

- Applicable to FPI investments in debt markets.

BUT THERE IS ONE CONDITION

- FPIs should voluntarily commit to retain a required minimum percentage of their investments in India for a particular period.

- Currently this period is of 3 years.

- The investment limit under VRR has been increased to ₹1,50,000 crore from the ₹75,000 crore of the earlier scheme, with a minimum retention period of three years.

- Investment limits will be available on tap and allotted on a first-come, first- served basis, the RBI said.

Latest Burning Issues | Free PDF

WhatsApp

WhatsApp