Table of Contents

It also seeks to amend three laws:-

- The Reserve Bank of India Act, 1934

- The Securities and Exchange Board of India Act, 1992

- The Multi-State Co-operative Societies Act, 2002.

WHY THERE IS A NEED FOR SUCH A BILL?

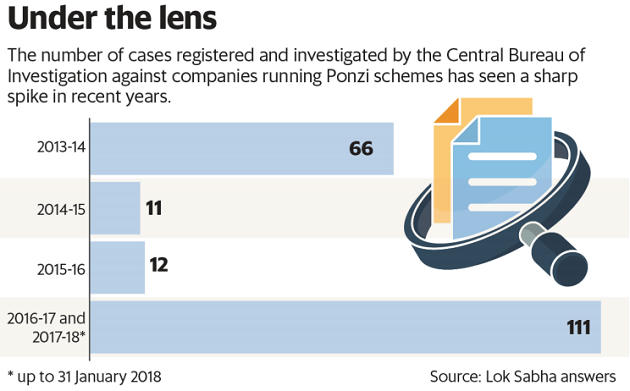

- Ponzi schemes are banned under the Prize Chit and Money Circulation (Banning) Act, 1978.

- Though it is a Central Act but the respective State government are the enforcement agency of this law.

- In 2016 The Securities and Exchange Board of India (SEBI) told the Supreme Court that banned Ponzi schemes do not fall under its regulatory purview.

PURPOSE OF THE BILL

- The bill aims to protect investors from fraudulent investment schemes, such as Ponzi schemes.

- Thus it provides for a mechanism to ban unregulated deposit schemes.

HISTORY OF PONZI SCHEMES

- Ponzi schemes are named after Charles Ponzi, an Italian-American who launched an investment scheme in Boston, US, in 1919, promising to double investors’ money—first in 90 days and then in 45 days.

- Ponzi, however, had no business model to double the money in such a short time. All he did was use money being brought in by the new investors to pay off the old investors.

- The scheme ran until the money being brought in by the new investors was more than the money being paid to the old investors.

- Once this equation reversed, the scheme collapsed.

MAJOR PONZI SCAMS

- Pearl Chit Fund of ₹49,000 cr. affected 5.5 crore depositors.

- The Oscar Chit Fund had deposits from 1.2 lakh people.

- Rose Valley

- Saradha

- Stock Guru

- Speak Asia

PROVISIONS OF THE BILL

Definition of Deposit-

- The Bill defines a deposit as an amount of money received through an advance, a loan, or in any other form, with a promise to be returned with or without interest. •

- Further, the Bill defines certain amounts which shall not be included in the definition of deposits such as amounts received in the form of loans from relatives.

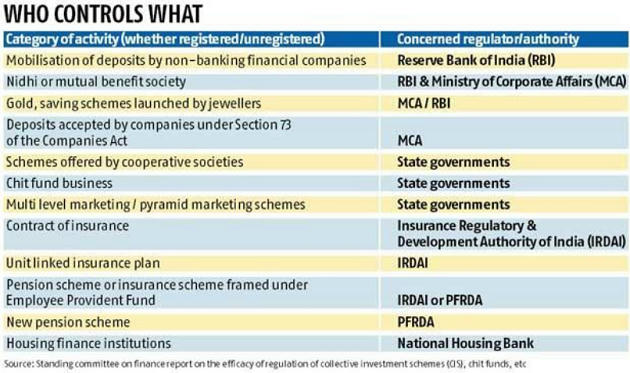

- Currently, 9 regulators oversee and regulate various deposit-taking schemes like- RBI, SEBI, Ministry of Corporate Affairs, State govt.

- For example, RBI regulates deposits accepted by nonbanking financial companies, SEBI regulates mutual funds, state governments regulate chit funds.

- All deposit-taking schemes are required to be registered with the relevant regulator.

Unregulated deposit scheme:-

- A deposit-taking scheme is defined as unregulated if it is taken for a business purpose and is not registered with the regulators listed in the Bill.

- The Bill bans unregulated deposit schemes.

Competent Authority:-

- The Bill provides for the appointment of one or more government officers, not below the rank of Secretary to the state or central government, as the Competent Authority.

- Police officers receiving information about offences committed under the Bill will report it to the Competent Authority.

Designated Courts:-

- The Bill provides for the constitution of one or more Designated Courts in specified areas.

- This Court will be headed by a judge not below the rank of a district and sessions judge, or additional district and sessions judge.

- The Court will seek to complete the process within 180 days.

Central database:-

- The Bill provides for the central government to designate an authority to create an online central database for information on deposit takers.

- All deposit takers will be required to inform the database authority about their business.

Offences and penalties:-

- The imprisonment ranges between 2 to 10 years for different offences.

- Along with a fine ranging from Rs 3 lakh to 5 crore rupees.

- Rashtriya Janata Dal’s Manoj Kumar Jha, while supporting the bill, said that the bureaucracy should not be given unbridled power that might create a state within a state, that might create problems later.

- He called for action on such deposits at the beginning itself.

WAY FORWARD

- The law helps to speed up the process of justice after a scamster is caught.

- But it is more important is to nip these schemes at early stage itself.

- For this, the officers of SEBI & RBI need to be more vigilant than they are.

- They need to be aware of Ponzi schemes while they are getting popular and spreading.

Latest Burning Issues | Free PDF

WhatsApp

WhatsApp