Table of Contents

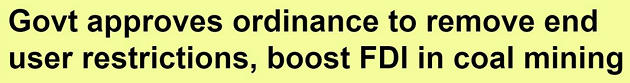

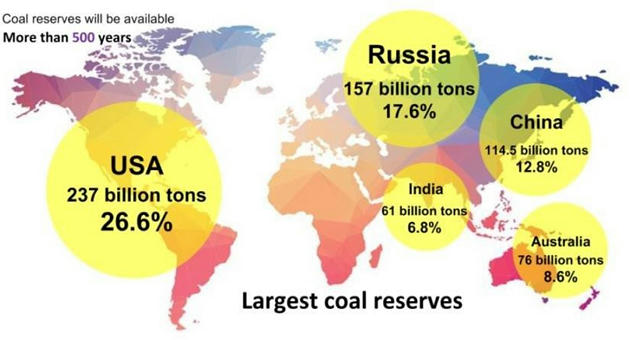

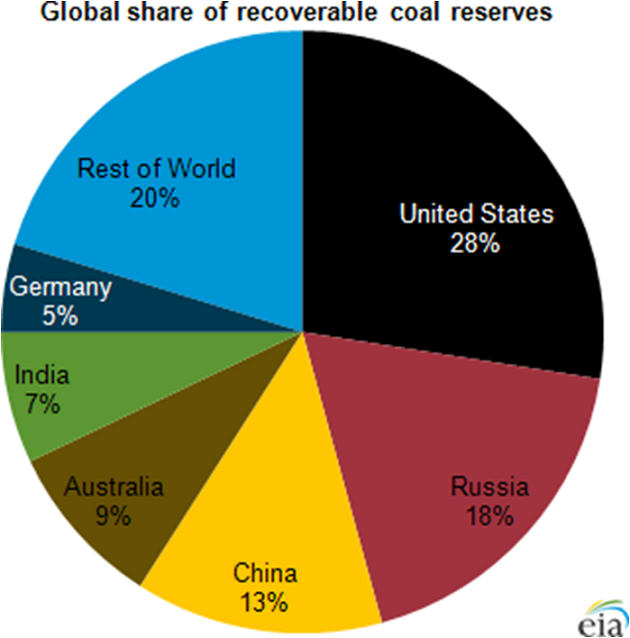

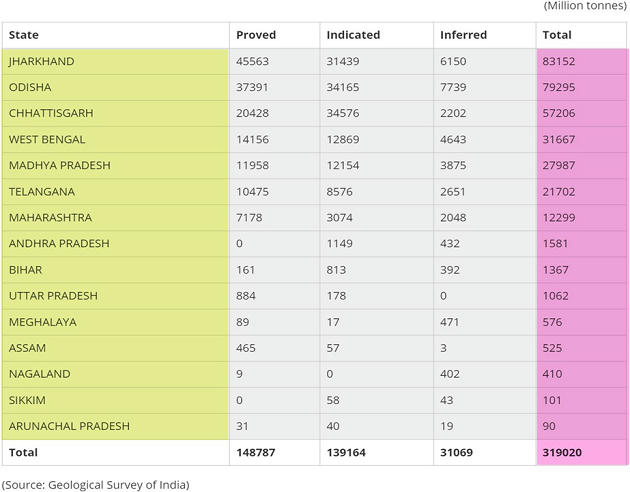

- Though India is the 4th largest resource in the world,

- It imported 235 million tonnes of coal last year.

- Of this, 135 million tonnes could have been substituted with domestic reserves.

- The total cost of that is Rs 1.71 lakh crore.

- Earlier, 100% FDI under the automatic route was allowed for coal mining for captive consumption by power projects, iron and steel and cement units.

- Section 11A of the Mines and Minerals (Development and Regulation) Act provides that The central government can auction coal and lignite mining licences only to companies engaged in- Iron and steel, Power and Coal washing sectors.

- The Cabinet has approved promulgation of Mineral Laws (Amendment) Ordinance 2020

- It will amend- The Coal Mines (Special Provisions) Act, 2015,

- The Mines and Minerals (Development and Regulation) Act, 1957. (iron ore mining lease will expire in March)

IMPACT OF THE ORDINANCE

- It allows coal mining for any company present in sectors other than steel and power.

- It dispenses away with the captive end-use criteria.

- The end-use restriction had led to “comparatively less” participation in the coal block auctions.

- Of 204 coal block allocations cancelled by the Supreme Court in 2014, only around 29 had been auctioned

- Previously, there was a restriction that anybody, to participate, should have the coal mine operation in India.

- This condition has now been removed.

- Thus, companies that do not have coal mine operations in India to also participate in coal block auctions.

BENEFITS

- Create an efficient energy market.

- Usher in competition.

- Reduce coal imports

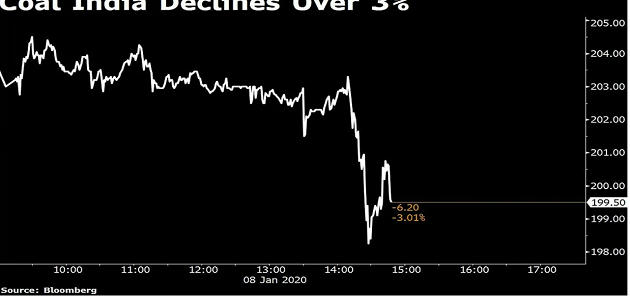

- It may also put an end to state-run Coal India Ltd’s (CIL’s) monopoly.

- India’s coal sector was nationalised in 1973.

Latest Burning Issues | Free PDF

WhatsApp

WhatsApp