Table of Contents

WHAT IS A NON-BANKING FINANCIAL COMPANY?

- NBFCs are financial institutions that offer various banking services but do not have a banking license.

- These institutions are not allowed to take traditional demand deposits.

- In India, NBFC is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities, leasing, hire-purchase, insurance business, chit business etc.

IS IT NECESSARY THAT EVERY NBFC SHOULD BE REGISTERED WITH RBI?

- NBFCs have to be registered with RBI

- But there are NBFCs which are regulated by other regulators like- SEBI, IRDAI.

- To avoid dual regulation, they are exempted from the requirement of registration with RBI. E.g.- Stock broking companies.

WHAT’S THE NBFC CRISIS?

- NBFCs borrow money from banks or sell commercial papers to mutual funds to raise money.

- These money is then given as a loan to small and medium enterprises, retail customers and so on.

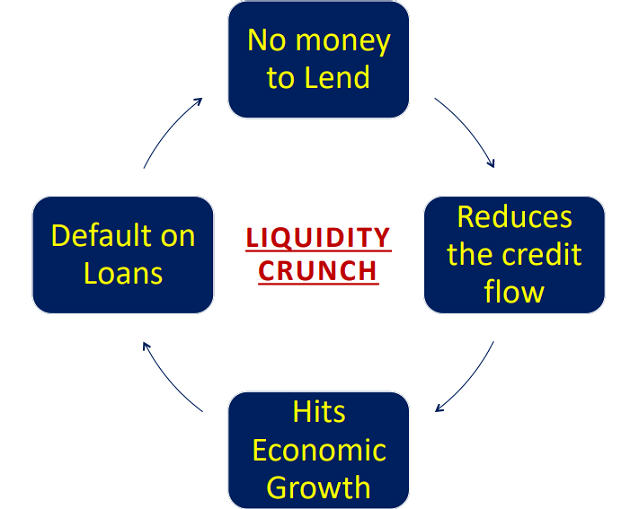

- But when NBFCs face liquidity crunch– this leads to NBFC CRISIS.

WHAT LED TO THE CURRENT CRISIS?

- 2 Reasons

First

- , the NBFC business model itself is flawed.

- It raises short-term funds which are then lent out as long-term loans.

- For example, an NBFC raises money by selling 6-month debt papers and on-lends this as a car loan with a tenure of 5 years.

- Now every time the NBFC has to renew the 6-month debt paper or raise fresh loans to repay the old debt paper.

- In good times, this happens very smoothly.

- But when times are tough, this cycle is broken.

Second,

- The cycle was broken by a default of some firms of the IL&FS group.

- This led to the fear among banks, mutual funds that more such entities could default.

- Due to this many institutions refused to give money to NBFCs.

- The cost of funds rose by 150 basis points for NBFCs.

- This led to the whole NBFC crisis.

IMPORTANCE OF NBFC IN INDIAN ECONOMY

- Mobilization of Resources

- Capital Formation

- Providing Long-term Credit

- Development of Financial Markets

Latest Burning Issues | Free PDF

WhatsApp

WhatsApp