Table of Contents

Ministry of Defence

- DRDO successfully test fires AKASH – MK -1S

- Defence Research and Development Organisation (DRDO) has successfully test fired AKASH-MK-1S missile from ITR , Chandipur, Odhisa on 25 and 27 May 2019.

- Akash Mk1S is an upgrade of existing AKASH missile with indigenous Seeker. AKASH Mk1S is a surface to air missile which can neutralize advanced aerial targets.

- The Akash weapon system has combination of both command guidance and active terminal seeker guidance. Seeker and guidance performance have been consistently established in both the missions. All the mission objectives have been met.

MCQ 1

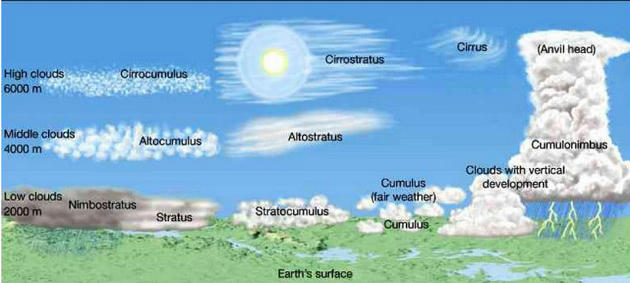

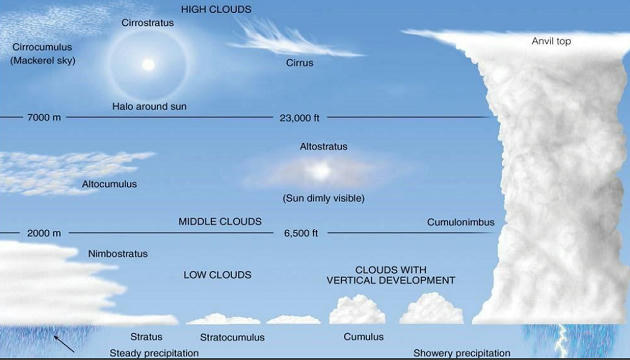

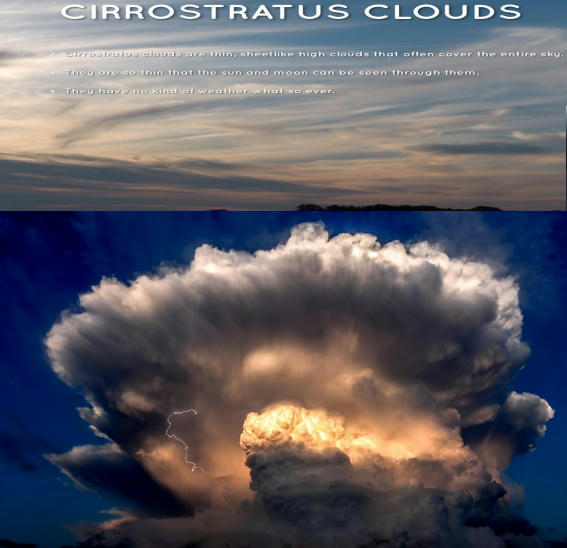

- ‘This type of cloud looks like cotton wool and are generally formed at a height of 4,000-7,000 m. They exist in patches and can be seen scattered here and there. They have a flat base.

- ‘ Which among the following type of clouds is best described by the above passage?

(a) Cirrus

(b) Cumulus

(c) Stratus

(d) Nimbus

MCQ 2

- The cause of inflation is :

A). increase in money supply

B). fall in production

C). increase in money supply and fall in production

D). decrease I money supply and fall in production

- Inflation is defined as a situation where there is sustained, unchecked increase in the general price level and a fall in the purchasing power of money. Thus, inflation is a condition of price rise.

- The reason for price rise can be classified under two main heads : (1) Increase in demand (2) Reduced supply.

- Suppose for Rs.100, last week you bought 5 Kg. of rice. This means that the cost of 1Kg of rice was Rs. 20. This week when you approached the same shop-keeper and paid Rs.100 to get rice, he gave only 4 Kg of rice. He also explained that the price of rice has increased, and now it is Rs.25 per Kg.

- This example clearly explains the fall in the purchasing power of money. For Rs. 100 you could get 5 Kg rice before, but now only 4 Kg. So purchasing power of money got reduced. This is inflation. And let’s us calculate the inflation rate (percentage). If price of rice, which was Rs.20 per Kg increased to Rs.25, this corresponds to Rs.5 increase on Rs.20, ie. 25% increase. So the inflation rate is 25%, which is obviously a very high rate.

MCQ 3

- Who among the following is most benefitted from inflation?

A). Government pensioners

B). Creditors

C). Savings Bank Account holders

D). Debtors

- I bought my property on the second year of my employment from housing board under hire purchase scheme. Cost was 55000 and balance amount to be paid by me is 40000.

- I am the debtor. Housing board is the creditor. My salary was 1000 and the instalment amount I have to pay per is 500. That is the EMI amount.

- In the initial years I struggled. The amount I have to pay remained same for 15 years, every month 500.

- Due to inflation, my salary kept on increasing, ( though certain increases are due to my promotion) . Likewise, due to inflation, property prices also kept increasing.

- at the end of 15 years, both my salary and the property value increased multifold. as a debtor, i benefitted by the inflation, provided inflation and consequential price increases are higher than rate of interest.

MCQ 4

- Inflation implies :

A). Rise in budget deficit

B). Rise in money supply

C). Rise in general price index

D). Rise in prices of consumer goods

MCQ 5

- The situation with increasing unemployment and inflation is termed as :

A). hyperinflation

B). galloping inflation

C). stag inflation

D). reflation

- Stagflation is persistent high inflation combined with high unemployment and stagnant demand in a country’s economy.

- Disinflation reduction in the rate of inflation.

- Deflation reduction of the general level of prices in an economy. Inflation in minus.

- Reflation is the act of stimulating the economy by increasing the money supply or by reducing taxes, seeking to bring the economy (specifically price level) back up to the long-term trend, following a dip in the business cycle.

- Skewflation refers to inflation in some commodities, deflation in others.

- Recession a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.

MCQ 6

- Which of the following can be used for checking inflation temporarily?

A). Increase in wages

B). Decrease in money supply

C). Decrease in taxes

D). None of these

- In a period of rapid economic growth, demand in the economy could be growing faster than its capacity can grow to meet it. This leads to inflationary pressures as firms respond to shortages by putting up the price. We can term this demand-pull inflation. Therefore, reducing the growth of aggregate demand (AD) should reduce inflationary pressures.

- The Central bank could increase interest rates. Higher rates make borrowing more expensive and saving more attractive. This should lead to lower growth in consumer spending and investment. See more on higher interest rates

- A higher interest rate should also lead to higher exchange rate, which helps to reduce inflationary pressure by

- Making imports cheaper.

- Reducing demand for exports and

- Increasing incentive for exporters to cut costs.

MCQ 7

- Who among the following are not protected against inflation?

A). Salaried class

B). Industrial workers

C). Pensioners

D). Agricultural farmers

- The types of investments that provide protection against inflation or the rise in prices of goods and services. Most hard assets are typically protected against inflation. This is because commodities tend to appreciate during times of high inflation.

MCQ 8

- The period of high inflation and low economic growth is termed as

A). stagnation

B). take-off stage in economy

C). stagflation

D). none of these 3

- Stagflation is persistent high inflation combined with high unemployment and stagnant demand in a country’s economy.

- Disinflation reduction in the rate of inflation.

- Deflation reduction of the general level of prices in an economy. Inflation in minus.

- Reflation is the act of stimulating the economy by increasing the money supply or by reducing taxes, seeking to bring the economy (specifically price level) back up to the long-term trend, following a dip in the business cycle.

- Skewflation refers to inflation in some commodities, deflation in others.

- Recession a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.

MCQ 9

- Inflation can be contained by :

A). Surplus budget

B). Increase in taxation

C). Reduction in public expenditure

D). All the above

- The government can increase taxes (such as income tax and VAT) and cut spending. This improves the budget situation and helps to reduce demand in the economy.

- Both these policies reduce inflation by reducing the growth of Aggregate Demand. If economic growth is rapid, reducing growth of AD can reduce inflationary pressures without causing a recession.

- BUT,

- If a country had high inflation and negative growth, then reducing aggregate demand would be more unpalatable as reducing inflation would lead to lower output and higher unemployment. They could still reduce inflation, but, it would be much more damaging to the economy

MCQ 10

- Deficit financing creates additional paper currency to fill the gap between expenditure and revenue. This device aims at economic development but if it fails, it generates

A). Inflation

B). Devaluation

C). Deflation

D). Demonetisation

- Deficit financing implies creation of additional money supply. Methods to cover the deficit financing are:

- By running down Government’s accumulated cash reserve from RBI.

- Borrowing from Reserve Bank of India and RBI gives the loans by printing more currency note

- Sale of government securities to the institutions/general public/ corporate houses

Objectives of Deficit Financing:

- To Bear War expenditure:- Deficit financing, generally being used as a method of financing big expenditure plans. It becomes difficult to arrange adequate resources. Therefore government has to adopt deficit financing.

- Diagnosis of Depression: – In developed countries/developing countries deficit financing is used as instrument of economic policy for removing the conditions of depression, because these countries suffer from lack of demand in the markets. Prof. Keynes has also suggested deficit financing as a remedy for depression and unemployment.

- Promotion of Economic development:- The main objective of deficit financing in an under developed country/ developing country like India is to promote economic development. Deficit financing additional money in the hands of the government to promote development works.

- Resources Mobilization: – deficit financing eases the movement of resources from one place to other, which created demand in the economy.

- To Grant Subsidies :- In a country like India government grants subsidies to the producers(farmers, entrepreneurs etc.) to encourage them to produce a particular type of commodity, granting subsidies is a very costly affair which we cannot meet with the regular income this deficit financing becomes must for it.

- Increase in Aggregate Demand: Deficit financing leads to increase in aggregate demand through increased public expenditure. This increases the income and purchasing power of the people and increases the availability of goods and services followed by the production and employment level.

Negative Effects of Deficit Financing

- Deficit financing is not free from its defects. It also has some negative impacts on economy. Important evil effects of deficit financing are given below.

- Inducement to Inflation: – Deficit financing may lead to inflation because deficit financing increases money supply & the purchasing power of the people which leads to increase in the price of the commodities.

- Adverse Impact on Saving:- Deficit financing leads to inflation and inflation affects the habit of voluntary saving adversely. Infect it is not possible for the people to maintain the previous rate of saving in the state of rising prices.

- Adverse Impact on Investment: – Deficit financing effects investment adversely when there is inflation in the economy trade unions/employees demand higher wages to survive. If their demands are accepted it increases the cost of production and de-motivates investors.

MCQ 11

- A steady increase in the general level of prices as a result of excessive increase in aggregate demand as compared to aggregate supply is termed as :

A). Demand-pull inflation

B). Cost-push inflation

C). Stagflation

D). Structural inflation

- Demand-pull inflation is asserted to arise when aggregate demand in an economy outpaces aggregate supply. It involves inflation rising as real gross domestic product rises and unemployment falls, as the economy moves along the Phillips curve. This is commonly described as “too much money chasing too few goods.”More accurately, it should be described as involving “too much money spent chasing too few goods,” since only money that is spent on goods and services can cause inflation. This would not be expected to happen, unless the economy is already at a full employment level. It is the opposite of cost-push inflation.

DOWNLOAD Free PDF – Daily PIB analysis

WhatsApp

WhatsApp