Table of Contents

BACKGROUND

- The RBI rolled out a policy in August 2014, pertaining to the amount and the number of ATM transactions offered by banks for free of charge.

- According to this policy, banks were instructed to provide a certain number of transactions free of cost to customers every month.

- Free transactions consist of both financial and nonfinancial transactions.

- Non-financial transactions include services such as balance enquiry, changing the ATM pin, mini statement, and booking a Fixed Deposit.

CLARIFICATION FROM RBI

- Non-cash withdrawal transactions – such as balance enquiry, cheque book request, payment of taxes and funds transfer – will not be part of the number of free ATM transactions, according to the RBI.

- Transactions failing on account of technical reasons such as hardware, software or communication issues and nonavailability of currency notes in the ATM for the customerShould not be counted as a transaction.

- All scheduled commercial banks – including regional rural banks, urban/state/district central co-operative banks, small finance banks and payment banks – as well as white label ATM operators have also been directed not to treat transactions failing due to reasons such as invalid PIN and validation among the free transactions allowed to a customer in a month.

HOW MANY FREE TRANSACTIONS?

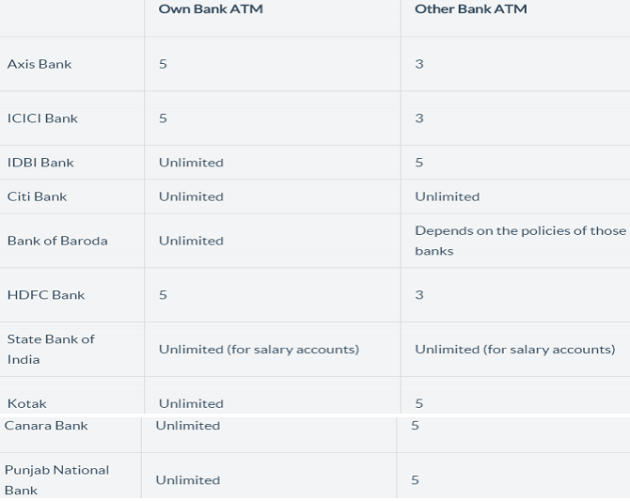

- The number of free transactions allowed to the customer every month varies, depending on factors such as-

- Type – whether the ATM is part of the home bank’s ATM.

- Location of the ATM – whether it is located in a metro city.

- For transactions at the ATMs in the network of the same bank as the account, the lenders offer a minimum of 5 free transactions in a month.

- For transactions at ATMs outside the home bank’s network but in one of six metros – Mumbai, Delhi, Chennai, Kolkata, Bengaluru and Hyderabad, they offer a minimum of 3 free transactions in a month.

- If outside these cities, a minimum of 5 transactions are provided.

- Once the number of free transactions has been utilised by the customer, the maximum fee that can be charged per transaction is Rs.20.

WHITE LABEL ATM

- White Label ATMs are operated by non-bank entities.

- Any non-bank entity with a minimum net worth of Rs.100 crore, can apply for white label ATMs.

- These ATMs doesn’t have a bank logo but their company’s logo.

BROWN LABEL ATM

- When banks outsourced the ATM operations to a third party.

- The ATM is owned and operated by a private company.

- ATM has logo of that bank.

- Here RBI is not directly involved.

Latest Burning Issues | Free PDF

WhatsApp

WhatsApp