Table of Contents

It’s time to give IRS officers their due

- CBDT a wing of the Ministry of Finance, has initiated disciplinary proceedings against some Indian Revenue Service (IRS) officers for a report they submitted to the government recently.

- The officers are not corrupt, nor did they abuse any Minister or any functionary of the government. So, what was their crime?

- A group of 50 IRS officers thought it their duty to help the government in this hour of crisis.

- They prepared a report titled ‘Fiscal Options and Response to Covid-19 Epidemic’, or FORCE, and submitted it to the government.

- In order to tide over the financial crisis, the report suggested

- Raising the highest slab rate to 40% for income above ₹1 crore or re-introducing the wealth tax for those with wealth of ₹5 crore or more.

- Providing an additional one-time cess of 4% on taxable income of ₹10 lakh and above for COVID-19 relief.

- Providing tax relief for sectors hit hard by COVID-19

- Re-introducing the inheritance tax.

Generalist versus Specialist

- FinMin is always headed by IAS

- The Revenue Secretary, the Expenditure Secretary and the Finance Secretary are all drawn from the IAS despite the fact that they have little experience in handling the economy.

- Starting as local administrators they later hold top posts in the Ministry of Finance.

- On the other hand, the CBDT is managed by IRS officers with rich field experience.

- There were suggestions time and again that the Chairman of the CBDT should be of the rank of Secretary to the Government of India. The government raised the status of the Chairman to that of a Special Secretary and not a full-fledged Secretary.

- At the time of the Budget, it is an IAS officer who accompanies the Finance Minister for the press briefing.

- The IRS officer is totally invisible, despite the Budget being the handiwork of hard-working IRS officers.

- Senior IRS officers know the intricacies of taxation, whether national or international.

- On the other hand, IAS officers know little about base erosion and profit sharing, transfer pricing, etc.

- And yet Revenue Administration is not in the hands of an IRS officer, but an IAS officer.

- The result is that the income tax law is a mess.

- In the past 60 years, the income tax law has never been mauled in a period of 12 months as it was in 2019-20.

- The financial year was practically extended from March to June.

- The Income Tax Act is a national disgrace, said Nani Palkhivala.

- Tax publishers are not able to bring out a proper single volume of income tax law.

- The blame for this squarely rests on the IAS officers who are above the IRS officers.

- The IAS maybe the ‘steel frame of India’ but the steel frame has been rusting for quite some time.

- Can the IRS be given their due and be allowed to play a normal role?

- The present controversy reignites the debate on the generalist versus the specialist.

- The FORCE report is sound. The IRS officers who wrote it deserve admiration and not admonition.

Forced to adopt new habits

- Starting new habits is tough and requires overcoming inertia.

- Most of the time humans like maintaining the status quo.

- The majority of us don’t change the default settings when we buy a new mobile phone.

- The tendency to stick with defaults happens across different aspects of our lives, from personal to social to office work.

- But this pandemic has jolted us out of our inertia.

- We’re now doing new things that we haven’t done before.

- One habit that we Indians are not used to is maintaining sufficient physical distance from one another in public spaces.

- There are many reasons for this. Urban cities are densely packed with people. Houses in slums are cramped.

- Few roads have footpaths, forcing pedestrians to take up a portion of the road.

- Lanes are narrow; even main roads are narrow.

- Trains and buses are always packed. Queues are long. The population is overwhelming.

- Behavioural science studies are showing evidence that a large part of human behaviour is led by environmental factors.

- The environment becomes part of our sub-conscious.

- We’re now seeing examples of behavioural design nudges in our environment that help us in maintaining distance in public spaces.

- Restaurants in Hong Kong are putting tapes over alternate tables so that people do not occupy tables next to each other.

- A bus station in Thailand has put stickers on alternate seats so that people sit leaving one seat empty.

Local motif

- Prime Minister Narendra Modi’s emphasis on Tuesday, on a renewed drive for a self-reliant India is not merely a reaction to the new global realities spawned by the COVID-19 pandemic.

- It is a throwback to the nationalist economic policies that India and other newly independent nations followed in the last century before the high tide of globalisation swept over.

- India opened itself to the global market in 1991 through its liberalisation, privatisation and globalisation policies, but remained cautious as it skirted around the whirlwind of international capital in the following decades.

- This insularity from disruptive global headwinds turned out to be helpful several times in the last three decades.

- PM Modi has always sought to strengthen India’s manufacturing base through the ‘Make In India’ initiative.

- Countries such as the U.S. that relied on others for the supply of essential medicines and medical equipment were suddenly vulnerable.

- This pandemic continues to illustrate how inseparably shared is the future of humanity, across national boundaries.

Liquidity lifeline

- Late March 2020: Relief to the poor and marginalised and RBI’s announcement in March and April.

- The first package focused on individuals at the bottom of the pyramid.

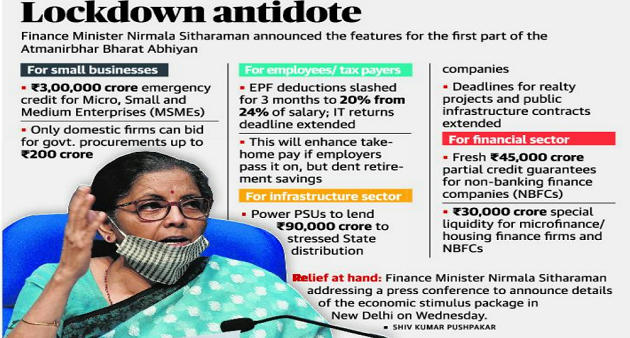

- From an overall perspective, the first tranche of announcements made by Finance Minister Nirmala Sitharaman under the Atmanirbhar Bharat Abhiyan on Wednesday is impressive indeed.

- The measures announced will go a long way in lifting the spirits of the two key and troubled sectors of MSMEs and non-banking finance companies.

- While for the former it is an existential crisis, for the latter it is one of liquidity.

- The massive ₹3-lakh crore collateral-free assistance handed out to MSMEs will help them crank up their operations.

- Ms. Sitharaman has done well in extending a sovereign credit guarantee for the complete amount as banks may otherwise have been reluctant to support troubled borrowers.

- The government could have specified the interest cap on these loans without leaving it to individual lenders as each of them has its own rate structure.

- Again, the scheme could have been extended until the end of this financial year instead of until October 31.

- India is now entering the monsoon season when activity is traditionally dull, so it is not clear how many borrowers will get the benefit.

- The ₹20,000 crore partially guaranteed subordinated debt programme and the ₹50,000 crore fund of funds scheme will help boost the equity portion on MSME finances but again, the finer details need to be clear.

- NBFCs, housing finance firms and micro finance entities get a much required liquidity boost in the form of a ₹30,000 crore scheme wherein their debt paper will be fully guaranteed by the government.

- With this, and the partial credit guarantee scheme of ₹45,000 crore, the government has broken the logjam wherein banks were unwilling to extend credit despite the RBI’s strong push.

- The Minister has also done well in addressing the liquidity issues of power distribution companies through a ₹90,000 crore infusion that will be securitised on their receivables and backed by a State government guarantee.

- Wednesday’s announcements are focused on the liquidity part of the crisis.

- The extension of three more months (June, July, August) provident fund support for businesses and workers — in companies employing fewer than 100 people, with 90% earning less than Rs 15,000 a month — is effectively a 24% wage support to small enterprises.

- The reduction in the contribution of both employees and employers in other companies to the provident fund (from 12% to 10%) will provide Rs 6750 crore of liquidity, split equally between companies and employees.

- Finally, in an attempt to put more money in the hands of people, the government announced a 25% reduction in tax deducted or collected at source, but only for non-salary payments.

- This covers everything from interest on fixed deposits to dividend and rent payments, and will result in Rs 50,000 crore more flowing into the system (which people will hopefully spend).

A plan to revive a broken economy

- The immediate need is to provide free food and cash transfers to those rendered incomeless.

- Providing every household with ₹7,000 per month for a period of three months and every individual with 10 kg of free foodgrains per month for a period of six months is likely to cost around 3% of our GDP (assuming 20% voluntary dropout).

- Food Corporation of India had 77 million tonnes, and rabi procurement could add 40 million tonnes.

- Cash transfers in many spheres will only enable current demand to continue (such as payment of house rent to continue occupancy) and not create any fresh demand.

- Putting money in the hands of the poor is the best stimulus to economic revival, as it creates effective demand and in local markets.

- For migrant workers, employment has to be provided to them where they are.

- The 100-day limit per household has to go; work has to be provided on demand without any limit to all adults.

- And permissible work must include not just agricultural and construction work, but work in rural enterprises and in care activities too.

- The revamped MGNREGS could cover wage bills of rural enterprises started by panchayats, along with those of existing rural enterprises, until they can stand on their own feet.

- Agricultural growth in turn can promote rural enterprises.

- In urban areas, it is absolutely essential to revive the Micro, Small and Medium Enterprises (MSMEs).

- The best way to overcome both problems would be to introduce an Urban Employment Guarantee Programme, to serve diverse groups of the urban unemployed, including the educated unemployed.

- The pandemic has underscored the extreme importance of a public health-care system, and the folly of privatisation of essential services.

- The post-pandemic period must see significant increases in public expenditure on education and health, especially primary and secondary health including for the urban and rural poor.

- A 2% wealth tax on the top 1% of the population, together with a 33% inheritance tax on the wealth they bequeath every year to their progeny, could finance an increase in government expenditure to the tune of 10% of GDP.

NEWS

- $3.6 mn in U.S. funding to Indian labs may be delayed

- A decision by the U.S. Centers for Disease Control and Prevention (CDC) to donate $3.6 million to Indian laboratories and research agencies to assist in countering the COVID-19 pandemic could run into delays, given that the agency has been placed on a “watch list” since December 2019, officials said here.

- CAPF canteens to go swadeshi

- A day after Prime Minister Narendra Modi appealed to people to use locally made products, Union Home Minister Amit Shah on Wednesday announced that all canteens of the Central Armed Police Forces (CAPF) would only sell swadeshi or products made in India.

- Taiwan wants to join hands with India

- Taiwan has proposed a regular communication channel with India to link up medical agencies to better cooperate in the fight against COVID-19, Foreign Minister Joseph Wu told The Hindu in an interview on Wednesday.

- ‘Huge loss for 21 major States’

- The lockdown caused 21 major States to suffer a collective revenue loss of about ₹97,100 crore for the month of April alone, according to estimates from India Ratings and Research (Fitch Group).

- Guidelines issued on use of AC in offices

- The guidelines said “maximum caution should be exercised to minimise the chances of spread of coronavirus through air flow in enclosed spaces like residences, offices, meeting places and assembly places”. Among the general principles were keeping the temperature between 24°C and 30°C, maintaining a relative humidity of 40%-70%, increasing the intake of fresh air and avoiding recirculating of air as much as possible and regular cleaning of filters.

- Nepal can let India use link road: Oli

- Nepal’s Prime Minister K. P. Sharma Oli on Wednesday proposed a solution to the ongoing border tension saying that Nepal can allow India to use the link road to the Lipulekh Pass as part of an agreement, but will not surrender the Kalapani territory on which India has been carrying out construction.

Download Free PDF – Daily Hindu Editorial Analysis

WhatsApp

WhatsApp